Title: Disaster Loan Eligibility: Comparing FEMA vs SBA Declaration Area Maps

Introduction:

When natural disasters strike, communities often find themselves in dire need of financial assistance to recover and rebuild. Two prominent organizations that offer such aid are the Federal Emergency Management Agency (FEMA) and the Small Business Administration (SBA). Understanding the eligibility criteria for disaster loans and comparing the declaration area maps provided by both organizations can help individuals and businesses navigate the process effectively. This article will delve into the differences between FEMA and SBA declaration area maps and highlight the key factors that influence disaster loan eligibility.

FEMA Declaration Area Maps:

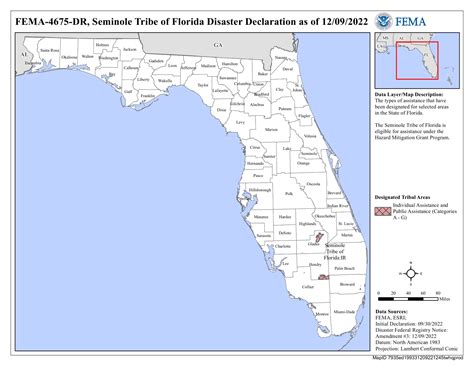

The Federal Emergency Management Agency (FEMA) is responsible for providing financial assistance to individuals and families affected by disasters. FEMA declaration area maps help determine eligibility for various types of disaster aid, including grants and low-interest loans.

1. Criteria for FEMA Declaration Area:

– A disaster must be declared by the President of the United States.

– The disaster must cause widespread damage or injury.

– The affected area must be eligible for federal assistance.

2. FEMA Declaration Area Maps:

– These maps display the boundaries of the disaster declaration areas.

– They help individuals and businesses determine if they are eligible for FEMA aid.

– FEMA maps are based on various factors, such as the type of disaster, extent of damage, and population affected.

SBA Declaration Area Maps:

The Small Business Administration (SBA) offers low-interest disaster loans to businesses of all sizes, private non-profit organizations, and homeowners. SBA declaration area maps play a crucial role in determining eligibility for these loans.

1. Criteria for SBA Declaration Area:

– A disaster must be declared by the President of the United States.

– The affected area must be eligible for federal assistance.

– The disaster must cause substantial economic injury to the area.

2. SBA Declaration Area Maps:

– These maps highlight the boundaries of the SBA declaration areas.

– They help businesses and organizations determine if they are eligible for SBA disaster loans.

– SBA maps consider factors such as the type of disaster, economic impact, and number of businesses affected.

Comparison of FEMA and SBA Declaration Area Maps:

While both FEMA and SBA declaration area maps serve the same purpose of determining eligibility for disaster aid, there are some notable differences:

1. Purpose:

– FEMA maps primarily focus on individual and family assistance.

– SBA maps target businesses, private non-profit organizations, and homeowners.

2. Aid Type:

– FEMA offers grants and low-interest loans to individuals and families.

– SBA provides low-interest loans to businesses and homeowners.

3. Application Process:

– FEMA aid is usually more straightforward and quicker to apply for.

– SBA loans require a detailed application process, including credit checks and financial documentation.

4. Timeframe:

– FEMA declaration areas are typically announced soon after a disaster occurs.

– SBA declaration areas may take longer to be announced, depending on the economic impact.

Conclusion:

Understanding the eligibility criteria for disaster loans and comparing the declaration area maps provided by FEMA and SBA is crucial for individuals and businesses seeking financial assistance after a disaster. While both organizations offer valuable support, it’s important to note the differences between their aid programs and maps. By familiarizing yourself with these details, you can ensure that you take advantage of the available resources to rebuild and recover.