Introduction:

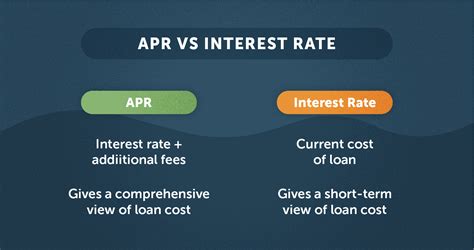

Embarking on a journey to become a licensed attorney is a significant milestone in one’s career. However, the path to achieving this goal often requires financial investment, particularly through bar study loans. With various repayment options available, understanding the risks associated with different loan terms is crucial. This article will delve into the risks of a bar study loan with a 15% Annual Percentage Rate (APR) and compare it with salary contingent repayment options.

1. Understanding Bar Study Loans:

Bar study loans are designed to help law students cover the costs of preparing for the bar exam, including tuition, study materials, and living expenses. These loans are typically offered by private lenders and have specific terms and conditions that borrowers must consider.

2. Risks of a 15% APR Bar Study Loan:

a. High Interest Rates: A 15% APR is considered high for student loans, making the total cost of borrowing significantly higher over time. This can lead to a heavier burden on borrowers’ finances.

b. Accumulated Interest: As interest accumulates on the loan balance, the total debt increases, potentially leading to a higher monthly payment in the long run.

c. Default Risk: With high-interest rates, borrowers may struggle to meet their monthly payments, increasing the risk of defaulting on the loan.

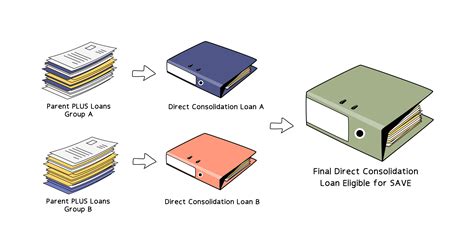

3. Salary Contingent Repayment Options:

a. Definition: Salary contingent repayment plans are designed to align the borrower’s monthly loan payments with their income. If the borrower’s income is low, their monthly payments will be reduced, and vice versa.

b. Benefits:

– Lower Monthly Payments: Salary contingent repayment options can significantly reduce the financial burden on borrowers, especially during the early stages of their careers.

– Flexibility: Borrowers can adjust their monthly payments based on their income, providing more financial stability.

– Potential for Forgiveness: Some salary contingent repayment plans may offer loan forgiveness after a certain number of years of qualifying payments.

4. Comparing Risks:

a. Interest Accumulation: Both the 15% APR bar study loan and salary contingent repayment options may accumulate interest over time. However, the high-interest rate of the former can lead to a more substantial debt burden.

b. Default Risk: The risk of default may be higher for a 15% APR bar study loan, as the high-interest rate can make monthly payments unaffordable for some borrowers. Salary contingent repayment options can mitigate this risk by adjusting payments based on income.

c. Loan Forgiveness: Salary contingent repayment plans may offer loan forgiveness, which is not typically available for bar study loans with a 15% APR.

Conclusion:

When considering a bar study loan, it is crucial to weigh the risks associated with a 15% APR against the benefits of salary contingent repayment options. While the high-interest rate of a 15% APR loan can lead to a significant debt burden, salary contingent repayment plans can provide financial stability and potentially offer loan forgiveness. Borrowers should carefully evaluate their financial situation and future income prospects to make an informed decision that aligns with their long-term goals.