Introduction:

The rise of electric vehicles (EVs) has been fueled by various incentives aimed at encouraging consumers to make the switch from traditional gasoline-powered cars. Two of the most popular incentives are the $7,500 tax credit and manufacturer rebates. This article delves into the differences between these two financing options and helps you determine which one is more beneficial for your electric vehicle purchase.

The $7,500 Tax Credit:

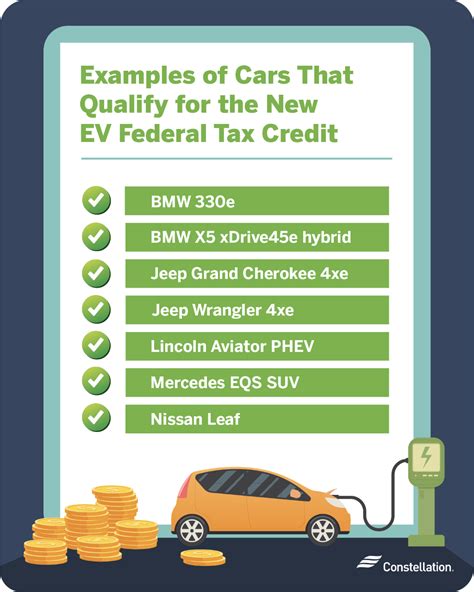

The $7,500 tax credit is a federal incentive available to eligible consumers who purchase a new qualifying electric vehicle. This credit is designed to offset the higher upfront cost of EVs compared to conventional vehicles. To qualify for the tax credit, the vehicle must be new, have a battery capacity of at least 4 kilowatt-hours, and be manufactured by a manufacturer that has sold no more than 200,000 qualifying vehicles through the end of the calendar year.

Advantages:

– Significant cost reduction: The tax credit can significantly lower the overall cost of purchasing an EV.

– Available for all eligible vehicles: The credit is applicable to a wide range of electric vehicles, making it accessible to a broad consumer base.

– Potential for full credit: If the price of the vehicle is below $60,000, the full $7,500 tax credit is available.

Disadvantages:

– Tax refund delay: The tax credit is applied when filing taxes, which means you won’t receive the benefit until after the purchase.

– Phase-out period: The tax credit is gradually reduced until it is no longer available once a manufacturer has sold 200,000 qualifying vehicles.

Manufacturer Rebates:

Manufacturer rebates are offered by car manufacturers as a way to incentivize consumers to purchase their electric vehicles. These rebates are applied directly to the purchase price of the vehicle, providing immediate cost savings.

Advantages:

– Immediate savings: Manufacturer rebates reduce the purchase price of the EV, providing immediate cost savings.

– Available for a limited time: Manufacturers may offer limited-time rebates, making them more attractive for those looking to take advantage of the savings.

– No tax refund delay: Unlike the tax credit, rebates are applied at the time of purchase, ensuring immediate savings.

Disadvantages:

– Limited availability: Manufacturer rebates are not available for all electric vehicles and may vary by model and manufacturer.

– Potential expiration: Some rebates have expiration dates, so it’s important to act quickly if you’re interested in taking advantage of the savings.

Conclusion:

When considering the purchase of an electric vehicle, it’s important to weigh the advantages and disadvantages of the $7,500 tax credit and manufacturer rebates. While the tax credit provides significant long-term savings, it may not be available for all vehicles or require waiting for a tax refund. On the other hand, manufacturer rebates offer immediate savings but may be limited in availability and have expiration dates. Ultimately, the best financing option for you will depend on your personal circumstances and preferences.