Introduction:

Debtors in Possession (DIP) financing has become an integral part of bankruptcy lending, offering companies the opportunity to continue operating while reorganizing their debts. However, this financing option comes with its own complexities, particularly when it comes to 20% carve-outs. This article delves into the intricacies of DIP financing and the challenges posed by 20% carve-outs in bankruptcy lending.

I. Understanding DIP Financing

A. Definition and Purpose

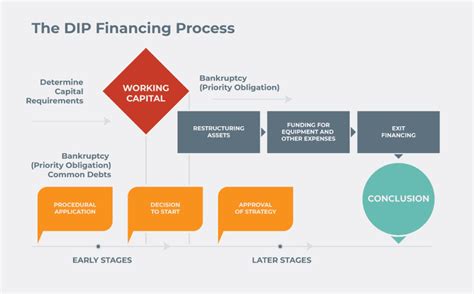

Debtors in Possession financing refers to loans provided to a company that is undergoing bankruptcy proceedings. The primary goal of DIP financing is to allow the company to continue operating and restructure its debts to emerge from bankruptcy as a viable entity.

B. Key Features

1. Temporary Nature: DIP financing is intended to be a short-term solution, typically lasting until the company can obtain a more permanent form of financing or reorganize its debts.

2. Priority of Payments: DIP financing typically takes priority over existing unsecured debt, ensuring that the lender is compensated before other creditors.

3. Collateral: DIP financing often requires collateral to secure the loan, reducing the risk for the lender.

II. The Role of 20% Carve-Outs

A. Definition

A 20% carve-out refers to a provision in a DIP financing agreement that requires the lender to allocate at least 20% of the loan proceeds to a specific purpose or account, such as a reserve for the benefit of creditors or to fund the company’s operations.

B. Challenges

1. Allocation of Funds: Determining how to allocate the 20% carve-out can be complex, as it must be done in a manner that is fair and equitable to all stakeholders.

2. Impact on Operations: Allocating a significant portion of the loan proceeds to a carve-out can impact the company’s cash flow and ability to continue operating effectively.

3. Negotiation: Negotiating the terms of the 20% carve-out can be challenging, as lenders and borrowers may have differing opinions on the appropriate allocation and usage of funds.

III. Strategies for Managing 20% Carve-Outs

A. Collaborative Approach

To address the complexities of 20% carve-outs, lenders and borrowers should engage in a collaborative approach to ensure that the carve-out is structured in a manner that benefits all parties involved.

B. Clear Communication

Open and transparent communication between lenders and borrowers is crucial to understanding the goals and expectations of each party and to facilitate the negotiation process.

C. Creative Solutions

In some cases, creative solutions may be required to address the challenges posed by 20% carve-outs. This may include modifying the carve-out requirements or finding alternative ways to protect the interests of creditors and lenders.

Conclusion:

DIP financing offers companies a lifeline during bankruptcy proceedings, but the complexities of 20% carve-outs can create significant challenges. By adopting a collaborative approach, clear communication, and creative solutions, lenders and borrowers can navigate these complexities and secure a successful outcome for all parties involved.