In the world of business financing, there are numerous options available to entrepreneurs and small business owners. Two popular choices are merchant cash advances and traditional loans. While both can provide the necessary capital to grow a business, they come with their own set of risks and complexities. This article will delve into one of the key distinctions between these two financial products: the 1.5 factor rate in merchant cash advances versus the Annual Percentage Rate (APR) in traditional loans.

**Understanding the 1.5 Factor Rate**

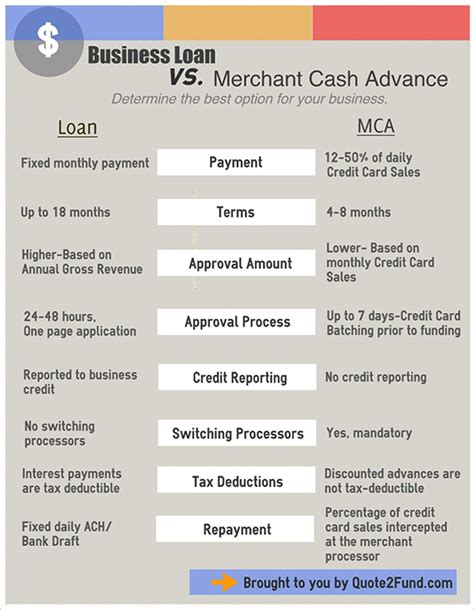

A merchant cash advance (MCA) is a type of short-term financing that provides businesses with immediate cash in exchange for a percentage of their future sales. One of the most significant features of an MCA is the 1.5 factor rate, which is a crucial component in determining the cost of the advance.

The 1.5 factor rate is essentially the multiple of the cash advance amount that the business must repay. For example, if a business receives a $10,000 cash advance with a 1.5 factor rate, they will be expected to repay $15,000 in total. This repayment is typically structured as a fixed percentage of the business’s daily sales until the advance is fully repaid.

The allure of an MCA lies in its simplicity and speed of approval, but the 1.5 factor rate can be a trap for businesses that are not fully aware of the implications. Here’s why:

1. **Hidden Costs**: The 1.5 factor rate might seem straightforward, but it often masks hidden costs. These costs can include origination fees, underwriting fees, and other charges that can significantly increase the total repayment amount.

2. **Variable Repayment**: Since the repayment is tied to the business’s sales, it can be unpredictable. If sales decline, the business may struggle to meet its repayment obligations, leading to potential defaults and late fees.

3. **High Repayment Amounts**: With a 1.5 factor rate, the repayment amount is 50% higher than the initial cash advance. This can place a substantial financial burden on the business, especially if it has limited capital reserves.

**Comparing to Traditional Loan APR**

In contrast, traditional loans typically come with an Annual Percentage Rate (APR), which is a more straightforward interest rate that is applied to the loan amount over a set period. The APR is expressed as an annual rate and can be a better indicator of the total cost of borrowing for a business.

Here are some points to consider when comparing the 1.5 factor rate to the traditional loan APR:

1. **Predictability**: An APR provides a clear, predictable cost of borrowing, making it easier for businesses to budget their finances.

2. **Lower Costs**: Traditional loans often have lower interest rates than MCAs with a 1.5 factor rate, which means businesses can borrow more money for less cost.

3. **Fixed Repayment Schedule**: With a traditional loan, businesses can expect a fixed repayment schedule, which can be easier to manage than the variable repayment structure of an MCA.

**Conclusion**

While merchant cash advances offer a quick and flexible financing solution, the 1.5 factor rate can be a trap that leads to unexpected financial strain. Businesses considering an MCA should carefully evaluate the terms and compare them to the more straightforward APR of traditional loans. By understanding the differences and potential pitfalls, entrepreneurs can make informed decisions that align with their long-term financial goals.