Title: Medical Emergency Loans with 0% Intro Rates vs Health Credit Cards: A Comprehensive Comparison

Introduction:

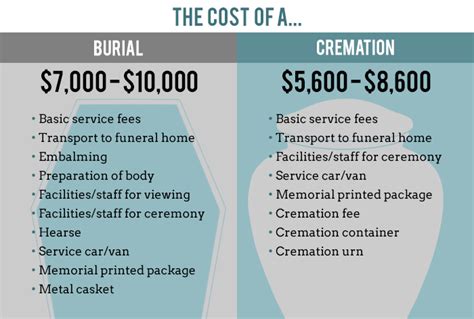

In the face of unexpected medical emergencies, financial planning becomes crucial. Two popular options for managing these expenses are medical emergency loans with 0% intro rates and health credit cards. This article provides a comprehensive comparison of these two financial tools, highlighting their benefits, drawbacks, and the best scenarios for utilizing each.

Medical Emergency Loans with 0% Intro Rates:

1. Definition:

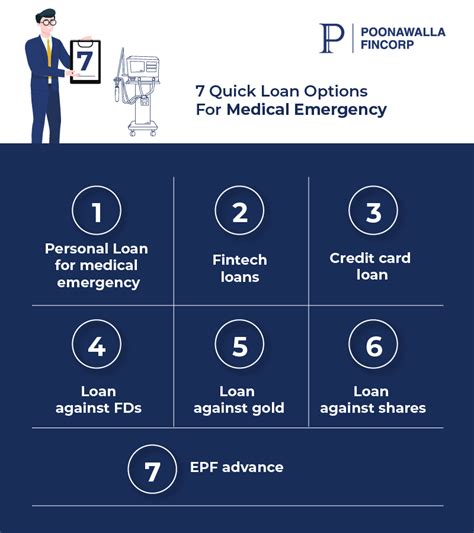

Medical emergency loans are short-term loans designed to cover unexpected medical expenses. They often come with a 0% intro rate for a specified period, making them an attractive option for borrowers.

2. Benefits:

a. Lower interest rates: The 0% intro rate can significantly reduce the cost of borrowing, making it easier to manage medical expenses.

b. Fixed repayment terms: Medical emergency loans typically have fixed repayment terms, allowing borrowers to plan their budget accordingly.

c. Quick approval process: Many lenders offer a streamlined approval process, enabling borrowers to access funds promptly.

3. Drawbacks:

a. Short repayment period: The 0% intro rate usually applies for a limited time, requiring borrowers to repay the loan quickly.

b. High fees: Some lenders may charge origination fees or other fees, which can increase the overall cost of the loan.

c. Credit score requirements: Borrowers with lower credit scores may find it challenging to qualify for these loans.

Health Credit Cards:

1. Definition:

Health credit cards are credit cards specifically designed to cover medical expenses. They often offer rewards or cashback on healthcare purchases and may have promotional interest rates for a limited time.

2. Benefits:

a. Rewards and cashback: Health credit cards can provide financial benefits in the form of rewards or cashback on healthcare purchases.

b. Flexibility: Borrowers can use health credit cards for various medical expenses, not just emergencies.

c. Longer repayment terms: Health credit cards typically offer longer repayment periods, allowing borrowers to spread out their payments.

3. Drawbacks:

a. Higher interest rates: Health credit cards often have higher interest rates compared to medical emergency loans, especially after the promotional period ends.

b. Potential for overspending: The availability of credit can lead to overspending, making it challenging to manage medical expenses effectively.

c. Limited use: Health credit cards may not be suitable for all medical expenses, as some may not qualify for rewards or cashback.

Conclusion:

Both medical emergency loans with 0% intro rates and health credit cards offer potential benefits for managing medical expenses. However, the best option depends on individual circumstances, such as credit score, repayment ability, and specific medical needs. Borrowers should carefully consider the pros and cons of each option before making a decision. It is also advisable to compare interest rates, fees, and repayment terms to ensure the chosen option aligns with their financial goals and constraints.