Introduction:

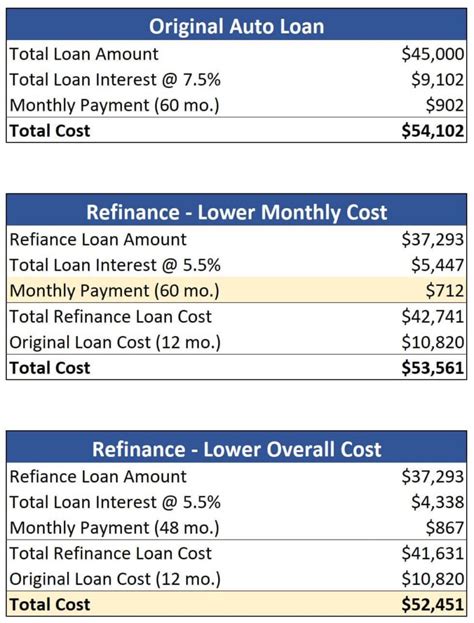

Auto refinancing has become a popular option for many car owners looking to secure better interest rates or lower monthly payments. However, understanding the various fees associated with this process is crucial to make an informed decision. In this article, we will compare two common fees: the $300 title transfer fee and lender origination costs. By delving into the details, you will be better equipped to choose the most cost-effective option for your auto refinancing needs.

1. Title Transfer Fee:

The title transfer fee is a one-time charge imposed by the state or local government when transferring the title of your vehicle from one owner to another. This fee is typically $300 or more, depending on the state. Here are some key points to consider:

– The title transfer fee is a fixed cost that is not negotiable.

– This fee is separate from the auto refinancing process and is required for any vehicle title transfer.

– The title transfer fee is usually non-refundable, even if you decide not to proceed with the refinancing.

2. Lender Origination Costs:

Lender origination costs are fees charged by the refinancing lender for processing your loan application. These costs can vary widely, and they may include:

– Application fee: A flat fee charged for processing your loan application.

– Underwriting fee: A fee for the lender’s underwriting department to review your application.

– Document preparation fee: A fee for preparing the necessary loan documents.

– Processing fee: A fee for the overall loan processing.

While lender origination costs can vary, they are generally lower than the title transfer fee. Here are some factors to consider when comparing lender origination costs:

– Lender origination costs are negotiable, and you may be able to negotiate a lower fee or have it waived altogether.

– These costs are typically rolled into your loan amount, which can increase your monthly payments or the total cost of your loan.

– Some lenders may offer lower origination costs in exchange for a higher interest rate or other terms.

Conclusion:

When deciding between a $300 title transfer fee and lender origination costs, it’s essential to consider the overall cost of refinancing your auto loan. While the title transfer fee is a fixed cost that you cannot avoid, lender origination costs can be negotiated and may be rolled into your loan. By comparing the total cost of refinancing, including both fees, you can make an informed decision that best suits your financial situation. Remember to read the fine print and ask questions to ensure you understand all the costs associated with your auto refinancing process.