In today’s competitive financial landscape, consumers are constantly seeking ways to save money while obtaining the services they need. One of the most significant advantages of choosing a credit union over a big bank is the opportunity to secure auto loan rates that are 1.5% lower than those offered by major banks. This article delves into the reasons behind this discrepancy and explores the numerous benefits that credit unions provide to their members.

1. Credit Union Auto Loan Rates

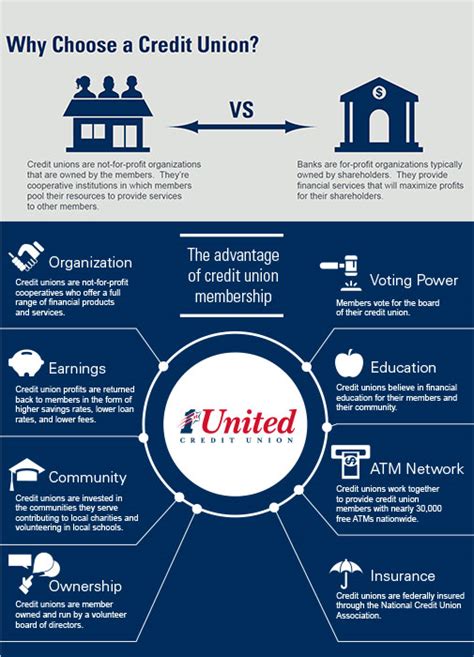

Credit unions are financial cooperatives owned and operated by their members. This unique structure allows credit unions to prioritize the interests of their members over profits, resulting in lower interest rates on loans, including auto loans. Credit unions can offer 1.5% lower auto loan rates than big banks due to the following reasons:

a. Lower overhead costs: Credit unions have fewer administrative expenses, as they operate with a focus on serving their members rather than generating profits for shareholders. This allows them to pass the savings on to their members in the form of lower interest rates.

b. Member-centric approach: Credit unions focus on building long-term relationships with their members, which fosters loyalty and trust. This approach enables credit unions to offer personalized service and better loan terms, including lower interest rates.

c. Community-oriented philosophy: Credit unions are deeply rooted in their communities and are committed to supporting local economies. By offering lower auto loan rates, credit unions encourage members to invest in their communities, further strengthening the local economy.

2. Additional Credit Union Advantages

a. Personalized service: Credit unions prioritize personalized service over faceless corporate relationships. This means that members can expect to receive individual attention and tailored solutions to their financial needs.

b. Competitive fees: Credit unions typically charge lower fees for services such as account maintenance, ATM withdrawals, and wire transfers compared to big banks.

c. Financial education: Credit unions often provide financial education resources to help members improve their financial literacy and make informed decisions about their money.

d. Community involvement: Credit unions are actively involved in their communities, supporting local events, organizations, and initiatives. This commitment to community involvement reflects the cooperative nature of credit unions and their dedication to making a positive impact.

In conclusion, choosing a credit union for your auto loan can result in significant savings, thanks to the 1.5% lower interest rates compared to big banks. The numerous advantages of credit unions, such as personalized service, competitive fees, and community involvement, make them an excellent choice for consumers looking to secure a favorable auto loan and enjoy a positive banking experience.