Introduction:

In the world of commercial real estate financing, borrowers often seek to maximize their borrowing capacity and secure the best possible terms. One innovative strategy gaining popularity is the combination of SBA 504 loans with conventional mortgages. This article explores the concept of SBA 504 loan stacking, its benefits, and how it can be effectively utilized alongside conventional mortgages.

What is an SBA 504 Loan?

The Small Business Administration (SBA) 504 loan program is designed to provide long-term, fixed-rate financing for small businesses. These loans are typically used for acquiring fixed assets, such as real estate, equipment, or furniture. The SBA guarantees a portion of the loan, which allows lenders to offer more favorable terms to borrowers.

How SBA 504 Loan Stacking Works:

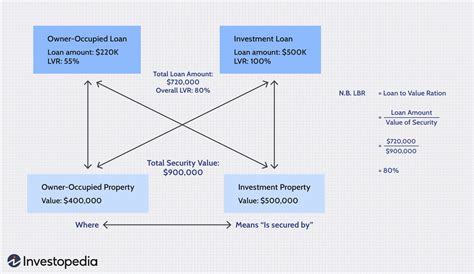

SBA 504 loan stacking refers to the practice of combining an SBA 504 loan with a conventional mortgage to finance a single property. This strategy allows borrowers to leverage the benefits of both loan programs, resulting in a more substantial financing package.

Here’s how it works:

1. The borrower applies for an SBA 504 loan, which covers up to 40% of the total project cost.

2. The borrower also applies for a conventional mortgage, which can cover up to 50% of the total project cost.

3. The remaining 10% is typically funded through the borrower’s equity investment.

Benefits of SBA 504 Loan Stacking:

1. Increased Borrowing Capacity: By combining an SBA 504 loan with a conventional mortgage, borrowers can access a larger financing package, enabling them to purchase more substantial properties or equipment.

2. Lower Interest Rates: The SBA 504 loan program offers below-market interest rates, which can result in significant savings over the life of the loan.

3. Longer Repayment Terms: SBA 504 loans have repayment terms of up to 20 years, which can help borrowers manage their cash flow more effectively.

4. Flexible Eligibility Criteria: The SBA 504 loan program has more lenient eligibility criteria compared to conventional mortgages, making it more accessible to small businesses.

Combining with Conventional Mortgages:

To effectively combine an SBA 504 loan with a conventional mortgage, borrowers should consider the following:

1. Lender Compatibility: Ensure that the lender offering the conventional mortgage is compatible with the SBA 504 loan program. Some lenders may not be experienced in handling these types of transactions.

2. Timing: The SBA 504 loan process can be lengthy, so it’s crucial to start the application process simultaneously with the conventional mortgage to avoid delays.

3. Documentation: Be prepared to provide comprehensive documentation for both loan applications, as this can streamline the process and reduce the likelihood of delays.

4. Loan Servicing: Confirm that the lender handling the conventional mortgage is willing to service the SBA 504 loan as well, ensuring a seamless experience for the borrower.

Conclusion:

SBA 504 loan stacking, when combined with conventional mortgages, offers a powerful financing solution for small businesses seeking to expand or acquire new assets. By leveraging the benefits of both loan programs, borrowers can secure more substantial financing packages, lower interest rates, and improved cash flow management. However, it is essential to work with experienced lenders and adhere to the proper process to ensure a successful transaction.