In the intricate world of credit reporting, errors are not uncommon. Consumers often find discrepancies in their credit reports that can negatively impact their financial standing. The Consumer Financial Protection Bureau (CFPB) plays a crucial role in addressing these issues by providing a platform for consumers to file complaints. This article delves into the success rates of credit disputes and the role of the CFPB in correcting errors.

Understanding Credit Disputes

A credit dispute occurs when a consumer challenges the accuracy of information on their credit report. This could be due to errors, identity theft, or outdated information. Consumers have the right to dispute any inaccuracies with the credit reporting agencies (CRAs) – Equifax, Experian, and TransUnion.

The Credit Reporting Process

When a consumer files a dispute, the CRA is required to investigate the matter within 30 days. The CRA must then provide the consumer with the results of the investigation, which may include corrections to the credit report. If the consumer is not satisfied with the outcome, they can escalate the matter to the CFPB.

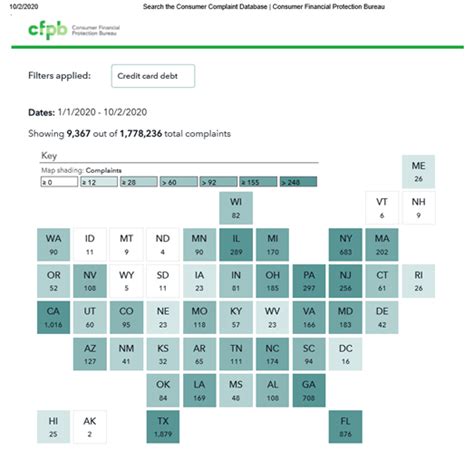

The Role of the CFPB

The CFPB was established in 2011 to protect consumers from financial abuses. One of its key responsibilities is to address consumer complaints regarding credit reporting. The CFPB collects and analyzes complaints from consumers and works with CRAs to resolve disputes.

Credit Dispute Success Rates

According to a report by the CFPB, the success rate for credit disputes is approximately 23%. This means that out of every 100 disputes filed, 23 are resolved in favor of the consumer. The success rate can vary depending on the nature of the dispute, the CRA, and the specific issue at hand.

Factors Influencing Success Rates

Several factors can influence the success rate of credit disputes:

1. The nature of the dispute: Disputes related to identity theft or outdated information tend to have higher success rates.

2. The CRA: Some CRAs may be more responsive to disputes than others.

3. The consumer’s approach: A well-documented and clear dispute can increase the chances of success.

Improving the Credit Dispute Process

The CFPB has been working to improve the credit dispute process for consumers. Some of the initiatives include:

1. Providing consumers with more information about their rights and the dispute process.

2. Encouraging CRAs to respond to disputes more promptly.

3. Offering a centralized platform for consumers to file complaints and track their progress.

Conclusion

Credit disputes can be a challenging process, but the success rate of 23% via CFPB complaints offers hope to consumers. By understanding the credit reporting process, consumers can take proactive steps to ensure the accuracy of their credit reports. The CFPB continues to play a vital role in protecting consumers and addressing credit reporting issues.