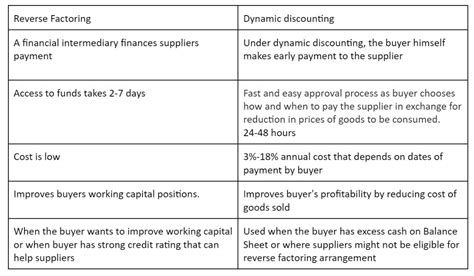

In the ever-evolving world of supply chain finance, businesses are constantly seeking innovative ways to manage their cash flow and reduce financing costs. Two popular methods that have gained traction are dynamic discounting and reverse factoring. While both have their advantages, they also come with their own set of pitfalls. This article will explore the key differences between dynamic discounting and reverse factoring, and highlight the potential challenges that businesses may face when implementing these strategies.

Dynamic Discounting: The Basics

Dynamic discounting is a modern supply chain finance solution that allows businesses to receive early payments on their invoices in exchange for a discounted amount. By offering flexible payment terms, dynamic discounting can help businesses improve their working capital and reduce the risk of late payments.

The process works as follows:

1. A business issues an invoice to a supplier.

2. The supplier submits the invoice to a dynamic discounting platform.

3. The platform analyzes the invoice and determines the available discount rate based on the supplier’s creditworthiness and payment history.

4. The supplier decides whether to accept the discount and, if so, the payment is processed immediately.

Dynamic Discounting Pitfalls

While dynamic discounting offers numerous benefits, there are several potential pitfalls to consider:

1. Discounting pressure: Suppliers may feel pressured to accept discounts, which could lead to a reduction in profit margins.

2. Lack of transparency: Some dynamic discounting platforms may not provide clear information about the discount rates and terms, making it difficult for suppliers to make informed decisions.

3. Over-reliance on cash flow: Businesses that become too reliant on dynamic discounting may find themselves with less cash on hand, which could be risky if other funding options are not available.

Reverse Factoring: The Basics

Reverse factoring is a supply chain finance solution where a business sells its accounts receivable to a third-party financier, often a bank or financial institution, at a discounted rate. The financier then pays the business the full amount of the invoice, less a fee, and collects the payment from the customer when it becomes due.

The process works as follows:

1. A business issues an invoice to a customer.

2. The business sells the invoice to a reverse factoring provider.

3. The provider pays the business the discounted amount of the invoice.

4. The provider collects the full amount of the invoice from the customer.

Reverse Factoring Pitfalls

Despite its advantages, reverse factoring also comes with its own set of challenges:

1. Cost: Reverse factoring can be expensive, as the business must pay a fee to the financier for their services.

2. Customer relationship strain: If customers are aware that their payment is being factored, it may damage the relationship between the business and its customer.

3. Reduced control: By selling accounts receivable to a third party, the business loses some control over its own cash flow and customer relationships.

Conclusion

Both dynamic discounting and reverse factoring offer valuable solutions for managing cash flow and reducing financing costs in the supply chain. However, businesses must carefully consider the potential pitfalls associated with each method to ensure they choose the best option for their specific needs. By understanding the risks and rewards of both dynamic discounting and reverse factoring, businesses can make informed decisions and optimize their supply chain finance strategies.