Introduction:

In the world of real estate investment, hard money loans have become a popular financing option for investors seeking quick access to capital. However, it is crucial to have a well-thought-out exit strategy to ensure a smooth transition from a hard money loan to a more permanent financing solution. This article will explore the concept of a 6-month refinancing countdown plan, which can help investors secure their investments and minimize risks associated with hard money loans.

1. Understanding Hard Money Loans:

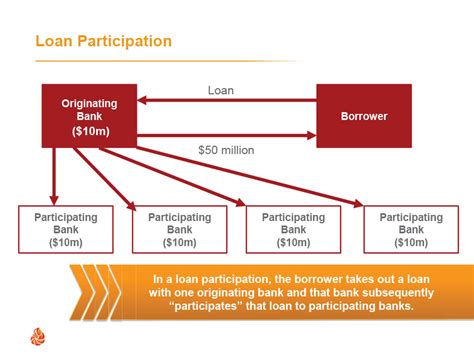

Before diving into the refinancing countdown plan, it is essential to understand the nature of hard money loans. These loans are typically short-term, asset-based, and offer quick funding for real estate investments. They come with higher interest rates and fees compared to traditional loans, making it crucial to have an exit strategy in place.

2. The Importance of an Exit Strategy:

An exit strategy is a plan that outlines how an investor will repay the hard money loan and transition to a more permanent financing solution. This strategy is vital for several reasons:

a. Minimize Risks: Hard money loans can be risky due to their higher interest rates and fees. An exit strategy helps mitigate these risks by ensuring a smooth transition to a more affordable financing option.

b. Preserve Equity: By refinancing to a lower-interest loan, investors can preserve their equity and increase their profit margins.

c. Flexibility: An exit strategy provides flexibility in managing the investment, allowing investors to adjust their plans based on market conditions and investment goals.

3. The 6-Month Refinancing Countdown Plan:

A 6-month refinancing countdown plan is a structured approach to refinancing a hard money loan. Here’s how it works:

a. Month 1-2: Research and Identify Refinancing Options:

During the first two months, investors should research and identify potential refinancing options. This includes exploring traditional bank loans, private lenders, or other financing solutions that offer lower interest rates and fees.

b. Month 3-4: Prepare Financial Documents:

In the third and fourth months, investors should gather and prepare all necessary financial documents, such as tax returns, financial statements, and property appraisals. These documents will be crucial when applying for refinancing.

c. Month 5: Apply for Refinancing:

By the fifth month, investors should have identified a refinancing option and applied for the loan. This process may involve submitting the prepared financial documents to the lender and waiting for approval.

d. Month 6: Close the Refinancing Deal:

In the final month, investors should finalize the refinancing deal and close the loan. This will involve signing the necessary documents and transferring the funds to repay the hard money loan.

4. Tips for a Successful Refinancing Countdown Plan:

To ensure a successful refinancing countdown plan, consider the following tips:

a. Start Early: Begin the refinancing process as soon as possible to avoid any delays or unexpected issues.

b. Maintain Strong Credit: A good credit score can help secure better refinancing terms and interest rates.

c. Stay Informed: Keep up-to-date with market conditions and interest rates to make informed decisions during the refinancing process.

Conclusion:

A 6-month refinancing countdown plan is an effective strategy for investors looking to transition from a hard money loan to a more permanent financing solution. By following this plan and staying proactive, investors can minimize risks, preserve equity, and secure their investments for long-term success.