In recent years, the landscape of student loan repayment has undergone significant changes, with the implementation of income-driven repayment (IDR) plans becoming increasingly popular. The latest statistics reveal a remarkable increase in the adoption of IDR plans, specifically a 10% to 15% surge in the transition to the 15% of Adjusted Gross Income (AGI) threshold.

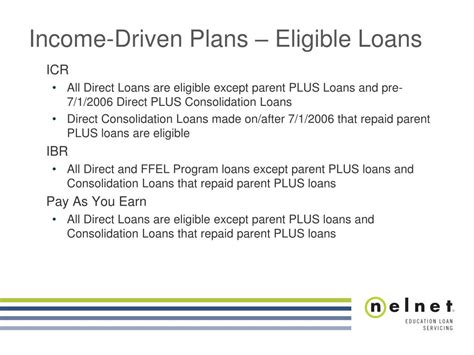

Income-driven repayment plans are designed to make student loan repayment more manageable for borrowers who find themselves struggling with their monthly obligations. These plans base the repayment amount on a borrower’s income and family size, making them an attractive option for those who earn less than the national median income.

The Federal Student Aid Office has been working tirelessly to make IDR plans more accessible and appealing. The recent 10% to 15% increase in the transition to the 15% AGI threshold is a significant step in that direction. This adjustment means that borrowers with lower incomes will now have the opportunity to enroll in IDR plans at a lower percentage of their AGI.

The transition from the previous 10% AGI threshold to the new 15% threshold has several implications for borrowers and the student loan industry as a whole. Here are some of the key points to consider:

1. Lower monthly payments: With the 15% AGI threshold, borrowers can expect lower monthly payments, which can ease the financial burden associated with student loan debt.

2. More borrowers eligible for IDR plans: The lower threshold makes it easier for borrowers with lower incomes to qualify for IDR plans, potentially leading to a higher percentage of borrowers benefiting from these plans.

3. Increased enrollment in IDR plans: The adjustment to the AGI threshold is likely to result in increased enrollment in IDR plans, as more borrowers find these plans to be a viable solution for managing their student loan debt.

4. Potential long-term savings: While IDR plans may lead to lower monthly payments, it’s important to note that extending the repayment period can result in higher interest charges. Borrowers should weigh the benefits of lower monthly payments against the potential for increased interest over time.

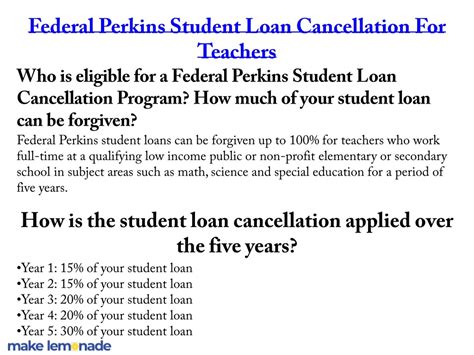

5. Impact on loan forgiveness: Borrowers who enroll in IDR plans may qualify for loan forgiveness after making qualifying payments for a certain period. The adjustment to the AGI threshold could potentially result in more borrowers becoming eligible for loan forgiveness.

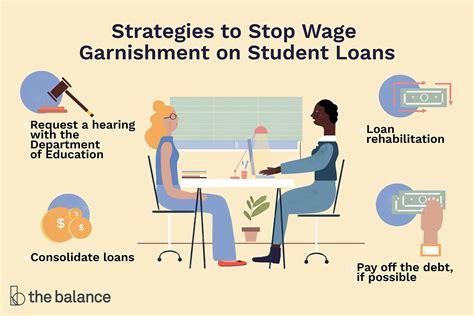

In conclusion, the recent 10% to 15% increase in the transition to the 15% AGI threshold for income-driven repayment plans is a positive step for borrowers seeking relief from student loan debt. As the student loan industry continues to evolve, it is crucial for borrowers to stay informed about these changes and take advantage of the options available to them. With the right approach, income-driven repayment plans can provide a much-needed lifeline for those struggling with student loan debt.