Title: Private Loan Variable Rates: The LIBOR Transition to SOFR and Its Impacts

Introduction:

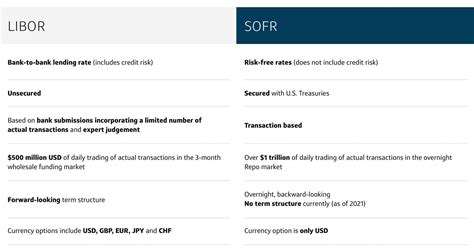

The transition from the London Interbank Offered Rate (LIBOR) to the Secured Overnight Financing Rate (SOFR) has been a significant development in the financial industry. As a result, private loan variable rates have been affected, causing concern among borrowers and lenders alike. In this article, we will explore the implications of this transition on private loan variable rates and the broader financial market.

Background:

LIBOR, a benchmark interest rate that has been widely used for over four decades, has been under scrutiny due to its potential manipulation and reliability issues. In response to these concerns, the Financial Conduct Authority (FCA) announced in 2017 that LIBOR would be phased out by 2021. The FCA recommended replacing LIBOR with alternative reference rates that are more robust and transparent, such as SOFR.

The Transition:

SOFR, developed by the Federal Reserve Bank of New York, is a benchmark interest rate based on actual overnight secured transactions in the federal funds market. The transition from LIBOR to SOFR has been a complex process, with various financial institutions and regulators working together to ensure a smooth transition.

Impacts on Private Loan Variable Rates:

1. Market Uncertainty: The transition has created uncertainty among borrowers and lenders regarding the future of variable rates. As SOFR is a relatively new benchmark, its volatility and stability are still being evaluated.

2. Rate Fluctuations: Since SOFR is a transaction-based rate, it may exhibit higher volatility compared to LIBOR, which is a survey-based rate. This could result in more frequent rate adjustments for private loans, affecting borrowers’ monthly payments.

3. Revising Loan Contracts: Lenders and borrowers will need to revise their loan contracts to reflect the transition from LIBOR to SOFR. This process may involve renegotiating loan terms and conditions, which could impact interest rates and fees.

4. Market Access: The transition could potentially affect market access for certain borrowers, especially those with riskier profiles. As SOFR is based on actual transactions, it may be more challenging for borrowers with limited access to secured financing to obtain private loans.

5. Regulatory Compliance: Financial institutions will need to ensure compliance with the new benchmark by adopting appropriate systems and procedures. This could require significant investment and resource allocation.

Conclusion:

The transition from LIBOR to SOFR has significant implications for private loan variable rates. While the transition aims to enhance the robustness and transparency of benchmark interest rates, it also introduces uncertainty and potential challenges for borrowers and lenders. It is crucial for market participants to stay informed and adapt to these changes to mitigate potential risks and capitalize on new opportunities.