Introduction:

When it comes to auto loans, understanding the various aspects of the agreement is crucial. One such aspect is the prepayment penalty, which occurs when a borrower decides to pay off their loan early. Two common methods used to calculate these penalties are the Rule of 78s and simple interest. This article will delve into these methods and help you understand their implications.

The Rule of 78s:

The Rule of 78s, also known as the sum-of-the-digits method, is a method used to calculate prepayment penalties on loans with balloon payments or those with variable interest rates. The name “Rule of 78s” comes from the sum of the digits of the number 78, which is the highest possible number of months in a loan term.

Under the Rule of 78s, the borrower is charged a penalty that is proportionate to the interest they would have paid if they had completed the entire loan term. This method spreads the interest payments over the life of the loan, with the highest interest being charged in the first months and the lowest in the last months.

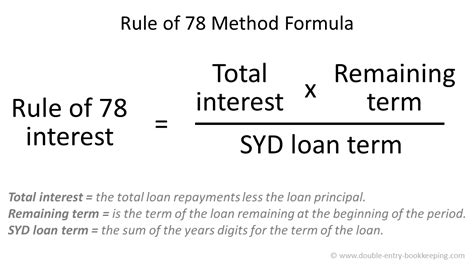

The formula for calculating the Rule of 78s penalty is as follows:

Penalty = (2 * Remaining Months) / (Total Months + 2)

For example, if you have a 60-month loan with 48 months remaining, the penalty would be calculated as:

Penalty = (2 * 48) / (60 + 2) = 0.727 or 72.7% of the remaining interest

Simple Interest:

In contrast, simple interest is a straightforward method of calculating the prepayment penalty. Under this method, the penalty is calculated based on the interest that would have been earned for the remaining months of the loan term.

The formula for calculating the simple interest penalty is as follows:

Penalty = (Remaining Months * Monthly Payment) / (Total Months + 1)

For example, if you have a 60-month loan with 48 months remaining and a monthly payment of $500, the penalty would be calculated as:

Penalty = (48 * $500) / (60 + 1) = $7,874.29

Comparison and Implications:

When comparing the Rule of 78s and simple interest methods, it is essential to note that the Rule of 78s often results in a higher penalty. This is because it spreads the interest payments over the life of the loan, resulting in a larger portion of the interest being charged in the early months.

On the other hand, the simple interest method is more straightforward and may result in a lower penalty. However, it is crucial to review your loan agreement carefully, as some lenders may use the Rule of 78s even if the loan does not have a balloon payment or variable interest rates.

Conclusion:

Understanding the difference between the Rule of 78s and simple interest methods for calculating auto loan prepayment penalties is crucial for borrowers. By being aware of these methods, you can make an informed decision when considering prepaying your auto loan. Always review your loan agreement and consult with a financial advisor if needed to ensure you fully understand the terms and conditions of your loan.