Title: DSCR Minimums: 1.25x vs 1.35x – A Comparison of Commercial Mortgage Approval Thresholds

Introduction:

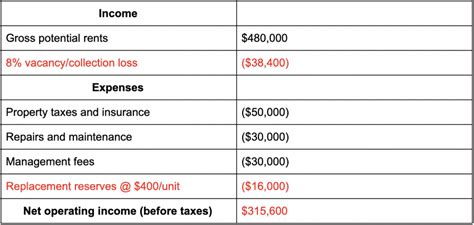

In the world of commercial real estate financing, Debt Service Coverage Ratio (DSCR) is a crucial metric used by lenders to assess the creditworthiness of borrowers. The DSCR is a financial ratio that measures a property’s net operating income (NOI) against its debt service. This article aims to compare the DSCR minimums of 1.25x and 1.35x, highlighting the differences in commercial mortgage approval thresholds.

Understanding DSCR:

Before diving into the comparison, it’s essential to understand what DSCR represents. The DSCR is calculated by dividing the property’s NOI by its annual debt service. A higher DSCR indicates a lower risk for lenders, as it demonstrates that the property generates sufficient income to cover its debt obligations.

1.25x DSCR Minimums:

A DSCR of 1.25x implies that the property’s NOI is 25% higher than its annual debt service. This threshold is considered a more lenient requirement for borrowers. Here are some key points to consider:

1.1. Lower Risk for Lenders:

With a DSCR of 1.25x, lenders are more confident in the borrower’s ability to repay the loan. This lower threshold makes it easier for borrowers to secure financing, especially those with less-than-perfect credit histories.

1.2. Increased Competition:

As the DSCR minimum is lower, more borrowers may qualify for commercial mortgages. This increased competition can lead to higher property prices and potentially higher interest rates.

1.3. Potential for Property Flipping:

A DSCR of 1.25x may encourage some borrowers to engage in property flipping, as they can secure financing with a lower income requirement. This could lead to an increase in speculative investment and potential market instability.

1.4. Limited Flexibility for Borrowers:

While a DSCR of 1.25x may make it easier to secure financing, it may also limit the flexibility for borrowers who require higher loan amounts or have specific property needs.

1.35x DSCR Minimums:

A DSCR of 1.35x is a more stringent requirement, indicating that the property’s NOI is 35% higher than its annual debt service. Here are some key points to consider:

2.1. Higher Risk for Lenders:

With a DSCR of 1.35x, lenders are taking on a higher level of risk. This threshold makes it more challenging for borrowers with lower credit scores or those with less-than-ideal financial situations to secure financing.

2.2. Reduced Competition:

The higher DSCR minimum can lead to a decrease in the number of borrowers who qualify for commercial mortgages. This can result in lower property prices and potentially lower interest rates.

2.3. Reduced Property Flipping:

A DSCR of 1.35x may discourage property flipping, as borrowers would need to demonstrate a higher level of income to secure financing. This can help maintain market stability and prevent speculative investment.

2.4. Increased Borrower Flexibility:

While the DSCR minimum is higher, borrowers who meet this threshold may have more flexibility in terms of loan amounts and property types.

Conclusion:

The choice between a DSCR minimum of 1.25x and 1.35x for commercial mortgage approval thresholds depends on various factors, including the borrower’s financial situation, market conditions, and lender preferences. A DSCR of 1.25x offers a more lenient requirement, making it easier for borrowers to secure financing but potentially leading to increased competition and property flipping. On the other hand, a DSCR of 1.35x is more stringent, reducing competition and property flipping but offering greater flexibility for borrowers who meet the threshold.