Title: Mezzanine Financing: A 15% IRR Versus Equity Dilution Models

Introduction:

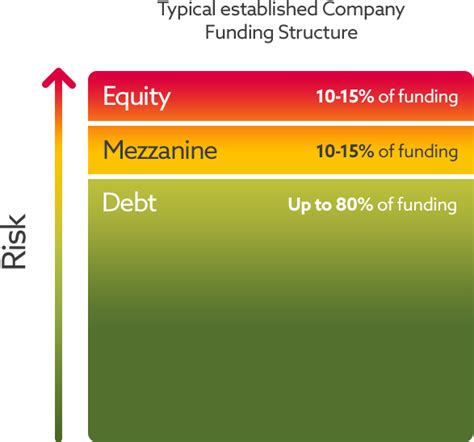

In the world of financing, companies often have to make strategic decisions about how to secure funding. Two popular methods are mezzanine financing and equity dilution. This article explores the differences between these two methods, focusing on a 15% internal rate of return (IRR) and their respective implications.

Mezzanine Financing:

Mezzanine financing is a hybrid financing structure that combines debt and equity elements. It typically features a high interest rate, often above the market rate for senior debt. This high interest rate is meant to compensate the mezzanine lender for the additional risk involved.

The benefits of mezzanine financing include:

1. Preserving equity: Since mezzanine financing is subordinated to senior debt, it does not dilute the equity ownership of existing shareholders.

2. Flexible repayment terms: Mezzanine financing can offer more flexible repayment terms compared to traditional debt.

3. Increased leverage: Mezzanine financing can allow companies to borrow more money than they could through traditional debt.

However, the drawbacks include:

1. High interest rates: The interest rate on mezzanine financing can be quite high, potentially impacting the company’s cash flow.

2. Potential for equity dilution: While mezzanine financing itself does not dilute equity, it can lead to dilution if the company cannot repay the loan and the lender has to convert the debt to equity.

15% IRR in Mezzanine Financing:

Assuming a 15% IRR in mezzanine financing, the benefits and drawbacks must be weighed carefully. The high IRR indicates that the project or investment has the potential to generate substantial returns, making it an attractive option for lenders. However, the high interest rates can put significant pressure on the company’s cash flow and may require a robust business plan to ensure successful repayment.

Equity Dilution Models:

Equity dilution occurs when a company issues new shares to raise capital. This can lead to a reduction in the ownership stake of existing shareholders. There are several equity dilution models, including:

1. Primary market offerings: The company issues new shares directly to investors in exchange for capital.

2. Secondary market offerings: Existing shareholders sell their shares to new investors, thereby diluting the ownership stake of other shareholders.

3. Employee stock options: Providing stock options to employees as a form of compensation can also lead to dilution.

Benefits of equity dilution models include:

1. Lower cost of capital: Equity financing is often cheaper than debt financing, as equity investors typically expect a higher return.

2. Flexibility: Equity financing allows companies to raise substantial amounts of capital without incurring high interest payments.

However, there are drawbacks to consider:

1. Ownership dilution: Existing shareholders lose a portion of their ownership stake.

2. Potential loss of control: If the new equity investors gain a significant stake, the existing management team may lose control over the company.

Conclusion:

Choosing between mezzanine financing and equity dilution models requires a careful assessment of a company’s specific circumstances. A 15% IRR in mezzanine financing can be appealing for lenders, but it may come at a high cost to the company. Conversely, equity dilution models may offer more affordable capital but at the expense of ownership and potential control. Ultimately, the right choice depends on the company’s financial needs, risk tolerance, and long-term objectives.