Introduction:

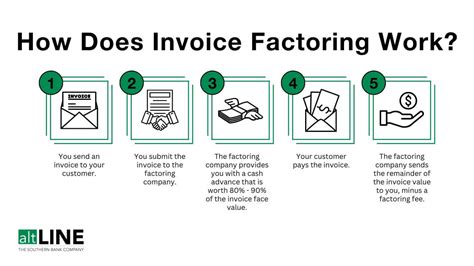

Invoice factoring is a financial service that provides businesses with immediate access to cash by selling their invoices to a third-party at a discount. While this service can be beneficial for businesses, it also presents opportunities for fraudulent activities. One common scheme involves fake purchase orders, which can lead to significant financial losses. In this article, we will discuss the signs of fake purchase order schemes in invoice factoring and how businesses can protect themselves from falling victim to such fraud.

Understanding Fake Purchase Order Schemes:

A fake purchase order scheme occurs when a fraudster creates a fraudulent purchase order and uses it to obtain payment from the seller. The seller, unaware of the fraud, ships the goods or services to the buyer, who then receives the shipment and makes the payment. However, the buyer does not intend to pay the seller, leaving the seller with unpaid invoices and a loss of goods or services.

Signs of Fake Purchase Order Schemes:

1. Unusual Payment Terms:

One of the first signs of a fake purchase order scheme is unusual payment terms. For instance, the buyer may request an expedited payment or ask for payment to be made directly to the seller’s bank account. These requests can be red flags, as legitimate buyers typically adhere to standard payment terms.

2. Poor Communication:

Fraudsters often use email or phone calls to communicate with sellers. If you notice poor communication, such as misspelled words, grammatical errors, or inconsistencies in the buyer’s information, it may be a sign of a fake purchase order.

3. Lack of Knowledge About the Seller:

A legitimate buyer should have a basic understanding of the seller’s business and products. If the buyer asks questions that seem out of context or displays a lack of knowledge about the seller’s offerings, it could be a sign of a fake purchase order.

4. No Purchase Order Number:

A genuine purchase order should have a unique purchase order number. If the buyer does not provide a purchase order number or gives an incorrect one, it may indicate a fraudulent scheme.

5. No Authorization from the Buyer’s Company:

Before making any shipment or providing services, it is essential to verify the authenticity of the purchase order with the buyer’s company. If you cannot confirm the order’s legitimacy, it may be a fake purchase order.

Protecting Your Business from Fake Purchase Order Schemes:

1. Conduct Due Diligence:

Before entering into any transaction, conduct thorough due diligence on the buyer, including verifying their contact information, business reputation, and payment history.

2. Verify Purchase Orders:

Always verify the authenticity of a purchase order by contacting the buyer’s company or using a third-party verification service.

3. Request Additional Documentation:

Ask for additional documentation, such as a signed contract or authorization from the buyer’s company, to ensure the purchase order is legitimate.

4. Communicate with Your Customers:

Maintain open lines of communication with your customers and be vigilant about any unusual requests or changes in their purchasing behavior.

Conclusion:

Spotting fake purchase order schemes in invoice factoring is crucial for businesses to protect themselves from financial loss. By being aware of the signs and taking proactive measures to verify the authenticity of purchase orders, businesses can minimize their risk of falling victim to such fraudulent activities.