In the intricate dance of credit scores and financial recovery, the FICO score is a pivotal metric that can significantly influence an individual’s ability to secure loans, mortgages, and even jobs. When credit scores plummet, the journey back to financial health can seem daunting. This article delves into the recovery timelines for two critical FICO score ranges, 620 and 720, focusing on how secured loans can help in the process.

### Understanding FICO Scores

FICO scores, ranging from 300 to 850, are a critical factor in determining an individual’s creditworthiness. Higher scores typically indicate a lower credit risk, making borrowers more likely to secure favorable interest rates and loan terms. Conversely, a lower score, such as a 620, can denote financial trouble and raise concerns among lenders.

### The 620 FICO Score Range

A FICO score of 620 is considered subprime, placing individuals in a higher risk category for lenders. This score range can be attributed to several factors, such as late payments, high credit card balances, or a lack of credit history. With a 620 score, the path to recovery is longer and more challenging.

#### Secured Loan as a Recovery Tool

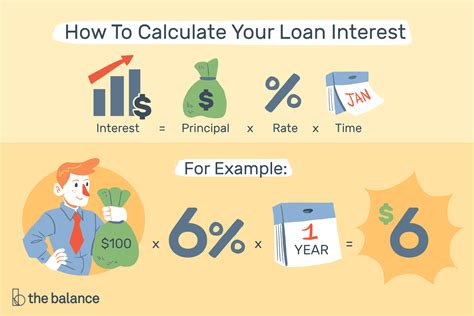

A secured loan can serve as a catalyst for rebuilding credit when used wisely. By offering collateral, borrowers can access better interest rates and loan terms, providing a more favorable financial foundation. Here’s a timeline for a 620 FICO score recovery using secured loans:

1. **Initial Secured Loan**: Obtain a secured loan with a manageable payment plan and a low interest rate. This will begin the process of establishing a positive payment history.

2. **Consistent Payments**: Make timely payments for the secured loan, as this will positively impact your credit score over time.

3. **Credit Utilization**: Keep credit card balances low and make payments in full each month to avoid high credit utilization ratios.

4. **Monitor Credit Score**: Regularly check your credit score to track progress. It may take 6 to 12 months to see significant improvement.

5. **Gradual Rebuilding**: Continue using secured loans responsibly and gradually increase the amount of credit you manage to demonstrate financial responsibility.

6. **Upgrade to Unsecured Credit**: Once your credit score reaches around 680, you may be eligible for unsecured loans, which will further improve your score.

### The 720 FICO Score Range

A FICO score of 720 is considered good and is often seen as a benchmark for favorable credit terms. While recovery from a 620 score to a 720 score can still take time, it is generally more manageable due to the lower starting point.

#### Secured Loan as a Recovery Tool

Similar to the 620 score range, secured loans can aid in the recovery process for a 720 FICO score. Here’s an accelerated timeline:

1. **Secured Loan Application**: Apply for a secured loan to establish a positive payment history and boost your score.

2. **Timely Payments**: Maintain timely payments to ensure your score continues to rise.

3. **Credit Mix**: Diversify your credit mix by incorporating other types of credit, such as credit cards or personal loans, to further enhance your score.

4. **Monitor and Adjust**: Regularly monitor your credit score and make adjustments to your financial habits as needed.

5. **Shorter Recovery Timeline**: With a 720 score, it may take anywhere from 3 to 6 months to reach the next benchmark.

### Conclusion

The road to credit score recovery is a marathon, not a sprint, and secured loans can play a pivotal role in this journey. Whether you start at a 620 or a 720 FICO score, understanding the timeline and utilizing secured loans responsibly can pave the way for a brighter financial future. Remember, patience, discipline, and a commitment to financial responsibility are key components of successful credit score resurrection.