Introduction:

Parental co-signing on student loans has been a common practice for many years, as it provides students with the financial backing they need to pursue higher education. However, as graduates enter the workforce, they often find themselves burdened by the debt their parents helped them secure. In this article, we will explore co-signer exit strategies and provide guidance on how to refinance parent-guaranteed student loans.

1. Understanding the Co-Signer Role:

A co-signer is someone who agrees to take on the responsibility of repaying a loan if the primary borrower fails to do so. When a parent co-signs on a student loan, they are essentially guaranteeing the loan, which means they are equally responsible for the debt. This is why it is crucial for co-signers to understand the implications of their decision.

2. Co-Signer Exit Strategies:

a. Loan Consolidation:

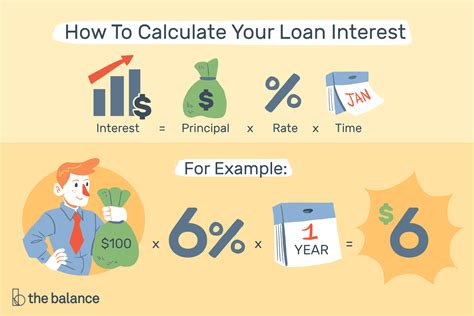

One of the most common co-signer exit strategies is loan consolidation. This involves combining multiple student loans into one new loan with a lower interest rate. By refinancing, the co-signer can remove themselves from the original loan, transferring the responsibility to the borrower.

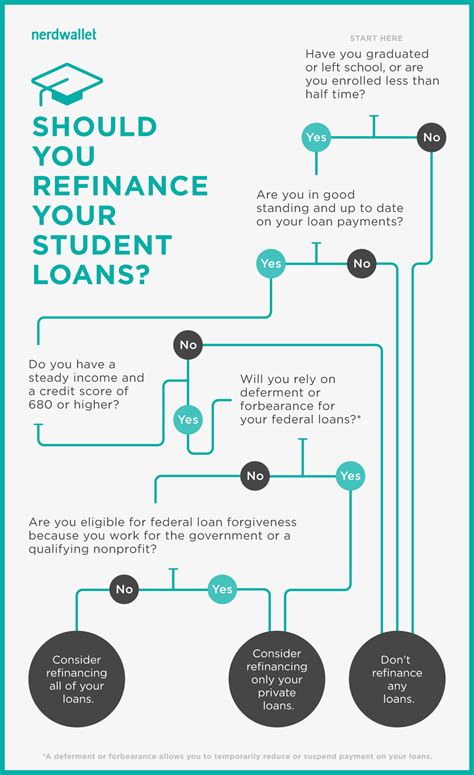

b. Private Student Loan Refinancing:

Another option is to refinance the student loan with a private lender. This process allows the borrower to take out a new loan in their name, with or without a co-signer. If the borrower has established a good credit history, they may qualify for a lower interest rate and pay off the loan without the co-signer.

c. Paying Off the Co-Signer:

In some cases, the borrower may choose to pay off the entire loan balance themselves. This requires careful financial planning and budgeting but can help remove the co-signer from the loan agreement.

3. Considerations for Refinancing:

a. Credit Score:

When refinancing a student loan, the borrower’s credit score will play a significant role in determining the interest rate and terms of the new loan. It is important for the borrower to have a good credit score to secure the best refinancing options.

b. Income and Employment:

Lenders will also consider the borrower’s income and employment status when refinancing a student loan. A stable income and steady employment can improve the chances of approval and a lower interest rate.

c. Debt-to-Income Ratio:

The borrower’s debt-to-income ratio will also be a factor in refinancing. A lower ratio may make it easier to qualify for a new loan and remove the co-signer.

Conclusion:

Exiting a co-signer from a parent-guaranteed student loan is an important step in taking control of one’s financial future. By understanding the co-signer’s role, exploring co-signer exit strategies, and considering the various refinancing options, borrowers can successfully remove their parents from the loan agreement and begin the journey to financial independence.