Introduction:

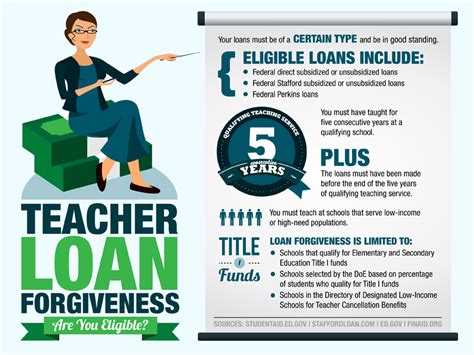

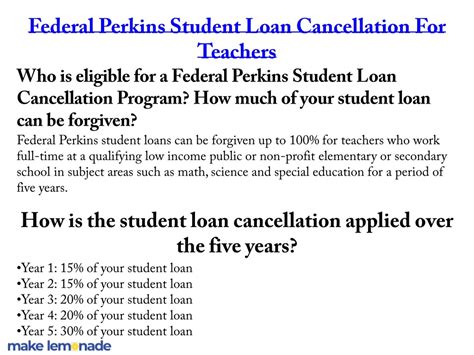

Teacher loan forgiveness programs are designed to alleviate the financial burden faced by educators who have taken out student loans to pursue their careers. Two of the most popular programs are the 5-Year and 10-Year Teacher Loan Forgiveness Programs. This article will explore the eligibility criteria for both programs, highlighting the differences and similarities between them.

Eligibility for the 5-Year Teacher Loan Forgiveness Program:

1. Full-time employment: To be eligible for the 5-Year Teacher Loan Forgiveness Program, you must have been employed as a full-time teacher for five consecutive years in a low-income school or educational service agency. “Full-time” is defined as working at least an average of 30 hours per week during the school year.

2. School type: The school in which you have been employed must be classified as a low-income school or educational service agency. This classification is determined by the U.S. Department of Education based on the school’s percentage of students eligible for free or reduced-price lunch.

3. Subject area: You must have taught one of the following subjects for at least 80% of the school year:

– Mathematics

– Science

– Special education

– Bilingual education and English language acquisition

– Reading or language arts for at least 45 days

4. Student loan debt: To qualify for the program, you must have a direct loan or a Federal Family Education Loan (FFEL) Program loan that is currently in an eligible repayment status.

Eligibility for the 10-Year Teacher Loan Forgiveness Program:

1. Full-time employment: Similar to the 5-Year program, you must have been employed as a full-time teacher for 10 consecutive years in a low-income school or educational service agency.

2. School type: The school in which you have been employed must also be classified as a low-income school or educational service agency.

3. Subject area: The subject area requirements are the same as those for the 5-Year program.

4. Student loan debt: To qualify for the 10-Year program, you must have a direct loan or an FFEL Program loan that is currently in an eligible repayment status.

Differences between the 5-Year and 10-Year Teacher Loan Forgiveness Programs:

1. Repayment period: The 5-Year program requires five years of consecutive teaching, while the 10-Year program requires 10 years.

2. Loan forgiveness amount: The 5-Year program forgives up to $17,500 of the total loan amount, while the 10-Year program forgives up to $17,500 as well, but it is spread over a longer period.

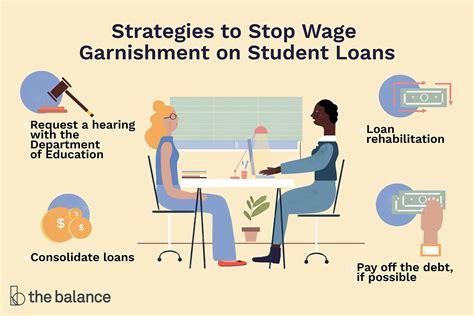

3. Eligibility for additional forgiveness: If you have remaining loan debt after completing the 5-Year program, you may still be eligible for the Public Service Loan Forgiveness (PSLF) program, which can forgive any remaining balance after 120 qualifying payments. However, if you complete the 10-Year program, you may not be eligible for PSLF.

Conclusion:

Both the 5-Year and 10-Year Teacher Loan Forgiveness Programs offer valuable financial relief for educators who have taken out student loans. Understanding the eligibility criteria for each program can help you make an informed decision about which option is best for your situation. Keep in mind that both programs require a commitment to teaching in a low-income school, so consider this factor carefully before applying.