Introduction:

Payday loans have become a popular financial solution for many individuals facing unexpected expenses. However, these loans often come with high-interest rates and hidden fees, leading to a cycle of debt. This article explores two case studies to shed light on the potential pitfalls of payday loans, comparing a $500 borrowed amount with a $1,200 repayment.

Case Study 1: The $500 Borrowed Scenario

Background:

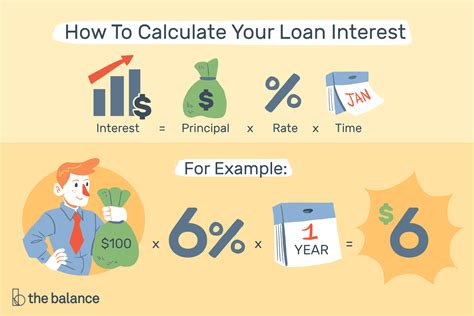

John, a single father, recently faced an unexpected medical emergency. With limited savings and a tight budget, he turned to a payday loan to cover the expenses. He borrowed $500, agreeing to repay the loan in two weeks, along with a $100 fee.

Outcome:

Unfortunately, John’s financial situation did not improve within the two-week period. When the repayment was due, he was unable to pay back the full amount of $600. As a result, he rolled over the loan, incurring additional fees and extending the repayment period.

The Trap:

John’s initial $500 loan quickly turned into a much larger debt. The high-interest rates and additional fees resulted in a repayment amount of $1,200, far exceeding the original borrowed amount. This trap left John struggling to meet his monthly expenses and falling deeper into debt.

Case Study 2: The $1,200 Repayment Scenario

Background:

Linda, a young professional, needed to purchase a new laptop for work. She decided to borrow $500 from a payday loan to cover the cost. However, due to the high-interest rates and hidden fees, her repayment amount was set at $1,200.

Outcome:

Linda’s intention was to repay the loan promptly and avoid any potential pitfalls. However, she soon realized that the $1,200 repayment was unaffordable. She struggled to manage her monthly expenses and other financial obligations, leading to late payments and increased fees.

The Trap:

Linda’s payday loan turned into a financial burden. The high-interest rates and hidden fees resulted in a repayment amount that was far beyond her expectations. This trap not only affected her ability to purchase the laptop but also caused stress and anxiety regarding her financial stability.

Conclusion:

The case studies presented in this article highlight the potential dangers of payday loans. The high-interest rates, hidden fees, and extended repayment periods can quickly turn a $500 borrowed amount into a $1,200 repayment. It is crucial for individuals to be aware of these traps and explore alternative financial solutions to avoid falling into a cycle of debt.