Title: Adjustable Rate Mortgage Reset: Year 6 Payment Shock Scenarios for 5/1 ARM

Introduction:

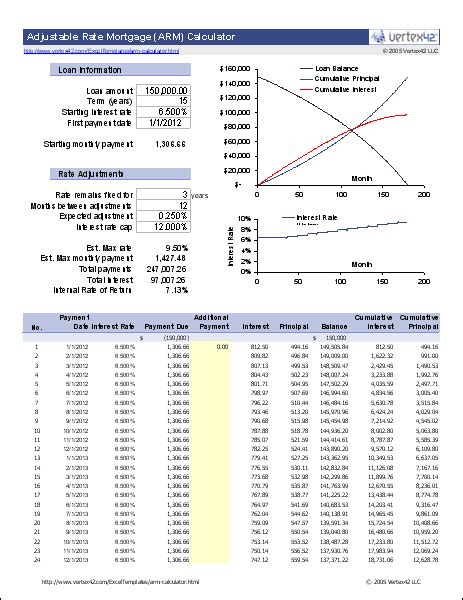

An Adjustable Rate Mortgage (ARM) is a popular home loan option that offers borrowers a low initial interest rate followed by periodic adjustments. The 5/1 ARM is a common type of ARM with an initial fixed rate for five years, after which the rate adjusts annually. This article will discuss the potential payment shock scenarios that borrowers may face in the sixth year of their 5/1 ARM, as the loan resets.

Section 1: Understanding the 5/1 ARM

To comprehend the payment shock scenarios, it is essential to understand the structure of a 5/1 ARM. This loan has an initial fixed rate for five years, followed by an adjustment period where the interest rate is recalculated annually based on an index, such as the U.S. Treasury rate or the London Interbank Offered Rate (LIBOR). The adjustment period is often the first year after the fixed period, but this can vary by lender.

Section 2: Payment Shock Scenarios

In the sixth year of a 5/1 ARM, borrowers may experience a payment shock due to the interest rate adjustment. Here are some common scenarios that can lead to a payment shock:

1. Increased Interest Rate:

If the index rate increases significantly since the loan’s initial rate was set, the borrower may face a substantial increase in their monthly payment. This is the most common scenario for a payment shock.

2. Loan Balance Recalculation:

ARMs typically use a loan balance recalculation method that takes into account the principal, interest, taxes, insurance, and any escrow amounts. When the rate adjusts, the loan balance may be recalculated, potentially resulting in a higher payment.

3. Caps and Limits:

Many ARM loans have caps that limit the amount the interest rate can increase in a single adjustment period. However, if the loan has no lifetime cap, the rate may adjust higher than the borrower anticipated, leading to a payment shock.

4. Negative Amortization:

In some cases, an ARM loan may have a negative amortization feature, which means the payment does not cover the full interest due, resulting in the loan balance increasing. This can happen if the rate adjusts higher, causing the payment to decrease and the principal to grow.

Section 3: Preparing for Payment Shock

To mitigate the impact of a payment shock in the sixth year of a 5/1 ARM, borrowers can take several steps:

1. Monitor ARM Rates:

Keep an eye on interest rates and ARM index values to anticipate potential adjustments. This can help borrowers plan and prepare for a rate increase.

2. Refinance:

If the ARM rate is expected to rise significantly, borrowers may consider refinancing to a fixed-rate mortgage before the reset period. This can provide long-term stability and avoid payment shock.

3. Increase Payment:

Borrowers can make larger payments during the fixed rate period to build equity and potentially reduce the principal balance. This may help minimize the impact of a rate increase in the sixth year.

4. Consult with a Financial Advisor:

It is essential to consult with a financial advisor or mortgage professional to understand the risks associated with an ARM and explore available options for managing payment shock.

Conclusion:

A 5/1 ARM is a flexible mortgage option that can provide borrowers with lower initial rates. However, it is crucial to be aware of the potential payment shock scenarios in the sixth year. By monitoring ARM rates, refinancing, increasing payments, and seeking professional advice, borrowers can better prepare for and manage any payment shock that may arise.