Introduction:

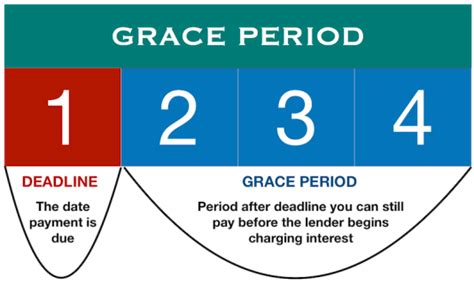

Visa overstay loans have become increasingly popular among individuals who find themselves in a financial bind after exceeding their visa duration. These loans provide a temporary financial solution to cover expenses until the individual can secure legal status or return to their home country. One common feature of these loans is the 30-day grace period, which allows borrowers to manage their finances without immediate repayment obligations. This article explores the various financing options available during this grace period.

1. Personal Loans:

Personal loans are a popular choice for visa overstay loans, as they offer flexibility and the 30-day grace period. These loans can be secured or unsecured, depending on the borrower’s creditworthiness. During the grace period, borrowers can use the loan funds to cover essential expenses, such as rent, utilities, and other bills.

2. Credit Cards:

Credit cards can be an effective financing option during the 30-day grace period, as they provide immediate access to funds. However, it is crucial to carefully manage credit card debt, as high-interest rates can accumulate quickly. Borrowers should aim to pay off the full balance during the grace period to avoid interest charges.

3. Payday Loans:

Payday loans are short-term loans designed to be repaid on the borrower’s next paycheck. While these loans can provide immediate relief, they often come with high-interest rates and strict repayment terms. It is advisable to use payday loans as a last resort and ensure that you can repay the loan during the 30-day grace period.

4. Installment Loans:

Installment loans offer fixed monthly payments over a specified period, making them a more manageable option for long-term financial obligations. During the 30-day grace period, borrowers can use the loan funds to cover their immediate needs while planning for future repayments.

5. Family and Friends:

In some cases, borrowing from family or friends may be the most accessible option during the 30-day grace period. This approach can be beneficial, as it eliminates the need for interest payments and provides a sense of support. However, it is crucial to communicate openly with your loved ones about the loan terms and repayment plan.

6. Non-Profit Organizations:

Several non-profit organizations offer financial assistance to individuals facing visa overstay situations. These organizations may provide interest-free loans or grants during the 30-day grace period, allowing borrowers to address their immediate financial needs without the burden of debt.

Conclusion:

Visa overstay loans with a 30-day grace period provide individuals with a valuable opportunity to manage their finances during a challenging period. By exploring various financing options, borrowers can secure the necessary funds to cover their expenses and plan for a return to legal status. It is essential to carefully consider the terms and conditions of each loan option to ensure that you can repay the debt without further financial strain.