Introduction:

When it comes to tackling debt, two popular methods stand out: the Debt Snowball and the Debt Avalanche. Both strategies aim to pay off debt as quickly as possible, but they differ in their approach. In this article, we will compare the Debt Snowball and Debt Avalanche methods using an 18-month payoff calculator, helping you determine which method suits your financial goals better.

Debt Snowball Method:

The Debt Snowball method involves paying off debts from the smallest to the largest balance, regardless of interest rates. This method provides psychological benefits by giving individuals a sense of accomplishment as they pay off each debt. Here’s how the Debt Snowball method works with an 18-month payoff calculator:

1. List all your debts, including their balances and interest rates.

2. Arrange the debts in ascending order based on their balances.

3. Allocate your monthly budget towards the smallest debt while making minimum payments on the rest.

4. Once the smallest debt is paid off, roll the monthly payment into the next smallest debt.

5. Repeat the process until all debts are paid off within 18 months.

Debt Avalanche Method:

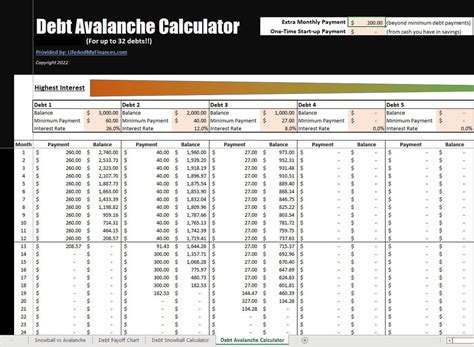

The Debt Avalanche method focuses on paying off debts with the highest interest rates first, regardless of their balances. This method is based on the principle that paying off high-interest debts saves you more money in the long run. Let’s see how the Debt Avalanche method works with an 18-month payoff calculator:

1. List all your debts, including their balances and interest rates.

2. Arrange the debts in descending order based on their interest rates.

3. Allocate your monthly budget towards the debt with the highest interest rate while making minimum payments on the rest.

4. Once the highest-interest debt is paid off, roll the monthly payment into the next highest-interest debt.

5. Repeat the process until all debts are paid off within 18 months.

Comparisons:

Now, let’s compare the two methods using an 18-month payoff calculator:

1. Total Interest Paid:

– Debt Snowball: The total interest paid may be slightly higher due to the lower monthly payments on high-interest debts.

– Debt Avalanche: The total interest paid is generally lower as high-interest debts are paid off first.

2. Time to Payoff:

– Debt Snowball: The Debt Snowball method may take longer to pay off the highest-interest debts, but it provides psychological benefits and motivation.

– Debt Avalanche: The Debt Avalanche method is faster in terms of paying off high-interest debts, resulting in significant savings over time.

3. Monthly Payments:

– Debt Snowball: Monthly payments may be lower in the early stages as you pay off smaller debts.

– Debt Avalanche: Monthly payments may be higher initially, as you focus on high-interest debts.

Conclusion:

Choosing between the Debt Snowball and Debt Avalanche methods depends on your personal preferences and financial goals. If you need the psychological boost of paying off smaller debts first and maintaining motivation, the Debt Snowball method might be suitable. However, if you prioritize saving money on interest and want to pay off high-interest debts faster, the Debt Avalanche method is the better choice. Use an 18-month payoff calculator to determine which method aligns with your financial objectives and embark on your debt-free journey.