Introduction:

The global financial crisis, especially the COVID-19 pandemic, has brought about unprecedented challenges for individuals and businesses alike. One of the measures adopted to alleviate the financial burden during these difficult times was the implementation of a debt moratorium, or payment freeze. This article explores the strategies behind debt moratoriums and their replication during the pandemic, analyzing their effectiveness and implications for the future.

I. Background on Debt Moratoriums

A. Definition and purpose

A debt moratorium is a temporary suspension of debt payments, allowing individuals or businesses to temporarily halt their financial obligations. The primary goal is to provide relief during times of economic hardship, enabling borrowers to recover and regain financial stability.

B. Historical context

Debt moratoriums have been employed in various forms throughout history, particularly during economic downturns or natural disasters. The 2008 financial crisis and the recent COVID-19 pandemic have prompted renewed interest in this measure.

II. Pandemic-Style Payment Freeze Replication

A. Government initiatives

During the pandemic, governments around the world implemented debt moratoriums to support their citizens and businesses. These initiatives included mortgage, student loan, and credit card payment freezes.

B. Challenges and limitations

While debt moratoriums provided some relief, they also presented challenges. Borrowers faced uncertainty regarding the duration and conditions of the freeze, and lenders incurred financial losses due to reduced interest income.

C. Replicating pandemic-style payment freezes

As economies recover from the pandemic, there is a growing interest in replicating the payment freeze strategy to support struggling borrowers and stimulate economic growth. However, the success of such initiatives depends on several factors.

III. Strategies for Debt Moratoriums

A. Temporary versus permanent freezes

Deciding whether to implement a temporary or permanent debt moratorium is crucial. Temporary freezes allow borrowers to regain financial stability while minimizing the impact on lenders. Permanent freezes, on the other hand, can provide long-term relief but may lead to prolonged economic downturns.

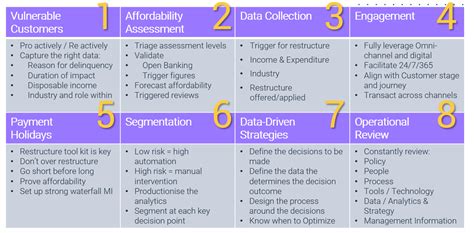

B. Targeting specific sectors or individuals

To maximize the effectiveness of debt moratoriums, it is essential to target the most vulnerable sectors and individuals. This may involve identifying industries hit hardest by the pandemic or providing assistance to low-income households.

C. Balancing borrower and lender interests

Striking a balance between borrower and lender interests is crucial to ensure the sustainability of the debt moratorium. This may involve offering interest rate subsidies, waiving penalties, or implementing alternative repayment plans.

IV. The Future of Debt Moratoriums

A. Lessons learned from the pandemic

The pandemic has provided valuable lessons on the effectiveness and limitations of debt moratoriums. These insights can inform future policy decisions and improve the design of debt moratorium programs.

B. Integration with broader economic policies

Debt moratoriums should be part of a comprehensive approach to economic recovery, including measures such as stimulus packages, tax incentives, and infrastructure investments.

Conclusion:

Debt moratoriums have proven to be a valuable tool in providing relief during economic downturns and natural disasters. The pandemic-style payment freeze replication has highlighted the need for targeted, balanced, and sustainable strategies. As economies continue to recover, policymakers must consider the lessons learned from the pandemic and integrate debt moratoriums into broader economic policies to support long-term growth and stability.