Introduction:

The world of real estate financing is vast and complex, with various options available to potential buyers. Two popular methods are co-op financing and proprietary lease approvals. While both offer unique advantages, they also come with their own set of complexities. This article will delve into the intricacies of co-op financing, comparing the requirements for a 50% down payment versus proprietary lease approvals.

Co-Op Financing:

Co-op financing is a unique method of purchasing a cooperative apartment. Unlike a traditional condominium or single-family home, co-ops are owned by a corporation, and shareholders live in the apartments. To purchase a co-op, buyers must undergo a rigorous application process, which includes a thorough financial review.

50% Down Payment:

One of the key requirements for co-op financing is a substantial down payment. Typically, buyers are expected to put down 50% of the purchase price. This high down payment is designed to ensure that buyers are financially committed to the property and have the means to maintain it.

The advantages of a 50% down payment include:

1. Lower monthly mortgage payments: With a larger down payment, buyers can secure a lower interest rate, resulting in smaller monthly mortgage payments.

2. Improved creditworthiness: A significant down payment demonstrates financial stability and can improve the buyer’s credit score.

3. Reduced risk for the co-op: A higher down payment reduces the risk for the co-op corporation, as the buyer has a substantial investment in the property.

Complexities of a 50% Down Payment:

Despite the advantages, there are complexities associated with a 50% down payment:

1. Large financial burden: Saving for a 50% down payment can be challenging, especially for first-time buyers.

2. Limited liquidity: A large down payment ties up a significant portion of the buyer’s savings, which may limit their ability to invest in other ventures.

3. Strict financial requirements: Lenders may have stricter requirements for borrowers with a 50% down payment, such as a higher credit score or proof of income.

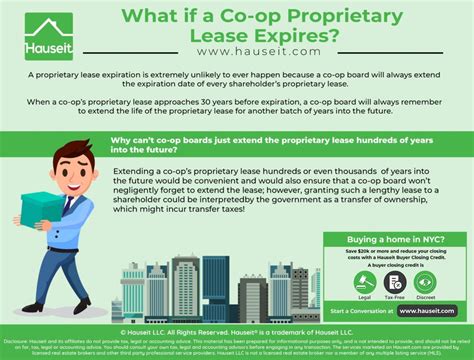

Proprietary Lease Approvals:

In some cases, buyers may opt for a proprietary lease, which is a lease-to-own agreement with the option to purchase the apartment at a later date. This method allows buyers to secure a co-op apartment without the need for a large down payment.

Complexities of Proprietary Lease Approvals:

While proprietary leases offer flexibility, they also come with their own set of complexities:

1. Higher upfront costs: Although proprietary leases require less of a down payment, they often come with higher upfront costs, such as application fees, broker fees, and a premium over the market rate.

2. Limited financing options: Proprietary leases may limit the buyer’s ability to secure traditional mortgage financing, which can be challenging if the buyer’s financial situation changes.

3. Risk of losing the deposit: If the buyer fails to meet the terms of the lease or is unable to purchase the apartment, they may lose their deposit.

Conclusion:

Co-op financing offers unique opportunities for potential buyers, but it also comes with its own set of complexities. The choice between a 50% down payment and a proprietary lease approval depends on the buyer’s financial situation, risk tolerance, and long-term goals. Understanding the intricacies of both methods can help buyers make an informed decision and navigate the co-op financing process successfully.