In the ever-evolving landscape of financial technology (fintech), the realm of merchant loans has witnessed significant transformation. With the advent of artificial intelligence (AI) and machine learning (ML), underwriting risk analysis has become more efficient, accurate, and streamlined than ever before. This article delves into the concept of 100% automated underwriting risk analysis for fintech merchant loans and its impact on the industry.

## Understanding Automated Underwriting

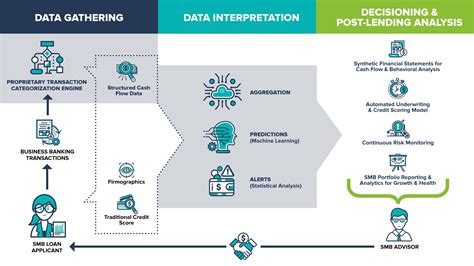

Automated underwriting is the process of evaluating loan applications using sophisticated algorithms and AI-driven analytics. This method eliminates the need for manual underwriting, which can be time-consuming and prone to errors. Instead, the underwriting process is automated, enabling lenders to provide instant approvals or rejections to borrowers.

## The Role of AI in Risk Analysis

AI plays a crucial role in risk analysis for fintech merchant loans. By analyzing vast amounts of data, AI algorithms can identify patterns, trends, and potential risks that may not be evident to human underwriters. This helps in making more informed decisions and reduces the likelihood of loan defaults.

## Benefits of 100% Automated Underwriting

### 1. Increased Efficiency

Automated underwriting reduces the time taken to process loan applications, from days to mere minutes. This allows lenders to offer instant approvals and disbursements, improving the overall customer experience.

### 2. Enhanced Accuracy

AI-driven algorithms can analyze data with greater precision than humans, leading to more accurate risk assessments. This helps in minimizing the risk of approving high-risk loans and ensures that borrowers with lower risk profiles receive the funding they need.

### 3. Cost Reduction

By automating the underwriting process, fintech companies can significantly reduce their operational costs. This includes minimizing the need for human underwriters, reducing training expenses, and cutting down on manual errors.

### 4. Scalability

Automated underwriting is highly scalable, allowing fintech companies to process a large volume of loan applications without compromising on the quality of risk assessment. This scalability is crucial for fintech businesses aiming to expand their market presence.

## Challenges of 100% Automated Underwriting

### 1. Data Privacy Concerns

As AI algorithms rely on vast amounts of data, concerns regarding data privacy and security arise. Ensuring that sensitive information is protected and complies with regulations is a significant challenge for fintech companies.

### 2. Bias in AI Algorithms

AI algorithms can inadvertently learn biases from the data they are trained on, leading to unfair treatment of certain borrowers. Ensuring that these biases are identified and mitigated is crucial for maintaining a fair and inclusive lending process.

### 3. Regulatory Compliance

Fintech companies must adhere to strict regulatory requirements, which can be challenging when implementing automated underwriting solutions. Ensuring compliance with regulations such as the General Data Protection Regulation (GDPR) and the Fair Credit Reporting Act (FCRA) is a critical aspect of 100% automated underwriting.

## Conclusion

100% automated underwriting risk analysis for fintech merchant loans is a game-changer in the lending industry. By leveraging AI and ML, fintech companies can provide faster, more accurate, and cost-effective loan services to their customers. While challenges such as data privacy and regulatory compliance remain, the potential benefits of this technology are undeniable. As the fintech landscape continues to evolve, automated underwriting is poised to play a vital role in shaping the future of lending.