Introduction:

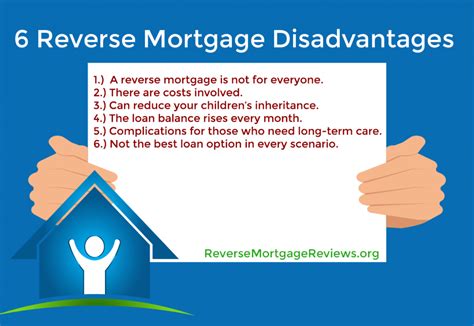

Reverse mortgages have gained popularity among homeowners over the age of 62 as a way to access home equity without selling their properties. However, this financial tool comes with its own set of risks and complexities, particularly concerning the 62+ age requirement and heir repayment rules. This article delves into the dangers associated with reverse mortgages, highlighting the potential pitfalls for borrowers and their heirs.

Section 1: The 62+ Age Requirement

One of the primary dangers of reverse mortgages is the strict age requirement of 62. This means that individuals under the age of 62 are not eligible for this financial solution. Here are a few risks associated with this age restriction:

1. Ineligibility for younger homeowners: Many younger homeowners may face financial hardships that could be alleviated through reverse mortgages. However, they are unable to benefit from this program due to the age restriction.

2. Inflation and rising home values: As the age requirement remains unchanged, younger homeowners may find themselves unable to take advantage of potentially increasing home values and lower interest rates in the future.

3. Dependence on retirement savings: By excluding younger homeowners, the 62+ age requirement may lead some individuals to rely more heavily on their retirement savings, potentially depleting these funds prematurely.

Section 2: Heir Repayment Rules

Another critical aspect of reverse mortgages is the repayment rules for heirs. Here are some potential dangers associated with heir repayment rules:

1. Heirs’ liability: If a borrower passes away or moves out of the property, their heirs may be responsible for repaying the loan balance. This can be a significant financial burden, especially if the heirs are unable to afford the repayment amount.

2. Property sale restrictions: Heirs must either repay the loan or sell the property to satisfy the debt. This can lead to a forced sale at a potentially unfavorable market price, especially during economic downturns.

3. Potential loss of inheritance: If the heirs decide to keep the property, they may be required to make a substantial down payment to satisfy the loan balance. This could significantly reduce the inheritance received from the deceased borrower.

Conclusion:

While reverse mortgages can be a valuable financial tool for eligible homeowners, they come with inherent risks, particularly regarding the 62+ age requirement and heir repayment rules. Borrowers and their heirs must carefully consider these dangers before deciding to pursue a reverse mortgage, ensuring they fully understand the potential consequences. Consulting with a financial advisor can provide additional guidance in navigating the complexities of reverse mortgages and making informed decisions.