Introduction:

As the countdown to the closure of the Parent PLUS Transfer Double Consolidation Loophole approaches, many borrowers are left wondering about the implications and the future of their student loan debt. This article aims to provide a comprehensive overview of the loophole, its impact, and the steps borrowers can take to navigate the upcoming changes.

Background:

The Parent PLUS loan program, introduced by the Federal Student Aid office, allows parents to borrow money on behalf of their dependent children to finance their higher education expenses. For years, this program has provided a lifeline to many families, helping them cover the costs of tuition, fees, and other related expenses.

The Double Consolidation Loophole:

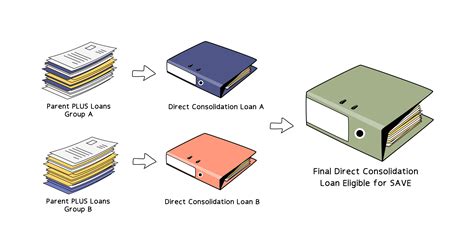

The Parent PLUS Transfer Double Consolidation Loophole has allowed borrowers to consolidate their Parent PLUS loans multiple times, effectively refinancing their debt and obtaining lower interest rates. However, this loophole has also resulted in significant tax consequences and financial advantages for some borrowers.

Countdown to Closure:

The U.S. Department of Education has announced the closure of the Parent PLUS Transfer Double Consolidation Loophole, which is expected to take effect from July 1, 2023. This decision has sparked a wave of concern among borrowers who have been benefiting from this loophole.

Impact of the Loophole Closure:

The closure of the Parent PLUS Transfer Double Consolidation Loophole is expected to have several impacts on borrowers, including:

1. Increased Interest Rates: Borrowers who consolidate their loans multiple times will no longer be able to secure lower interest rates, which could result in higher monthly payments.

2. Tax Consequences: Borrowers who have refinanced their Parent PLUS loans through the loophole may face tax consequences, as the refinanced amount will be considered a new loan, subject to tax treatment.

3. Limited Consolidation Options: Borrowers will have limited options for consolidating their Parent PLUS loans after the closure of the loophole, making it difficult to manage their debt effectively.

Steps Borrowers Can Take:

To navigate the upcoming changes, borrowers can take the following steps:

1. Evaluate Current Loan Situation: Borrowers should review their current Parent PLUS loan balance, interest rates, and payment plans to understand the impact of the loophole closure.

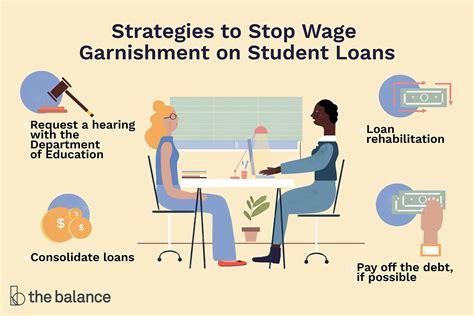

2. Consider Consolidation Options: Before the closure of the loophole, borrowers may want to consider consolidating their loans to secure the best interest rates possible.

3. Seek Professional Advice: Borrowers can consult with financial advisors or loan counselors to explore alternative solutions for managing their student loan debt.

4. Plan for Future Payments: Borrowers should develop a realistic budget that accounts for the increased monthly payments resulting from the closure of the loophole.

Conclusion:

The countdown to the closure of the Parent PLUS Transfer Double Consolidation Loophole is a critical time for borrowers to understand the implications and take appropriate actions. By evaluating their current loan situation, exploring consolidation options, and seeking professional advice, borrowers can navigate the upcoming changes and manage their student loan debt more effectively.