Introduction:

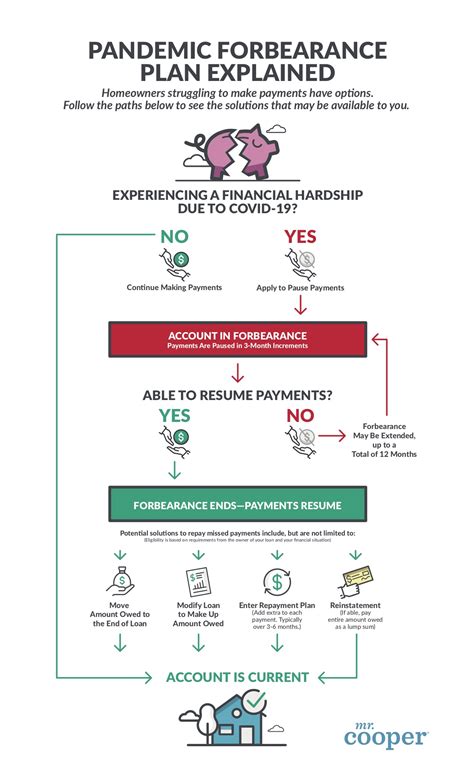

As the world grapples with the aftermath of the COVID-19 pandemic, many borrowers have benefited from the temporary relief offered through pandemic forbearance programs. However, as these programs come to an end, borrowers are faced with the challenge of transitioning to new repayment plans. This article will provide a comprehensive guide on the differences between the 0% interest and IDR (Income-Driven Repayment) plans, helping borrowers make an informed decision during this transition period.

Section 1: Understanding the End of Pandemic Forbearance

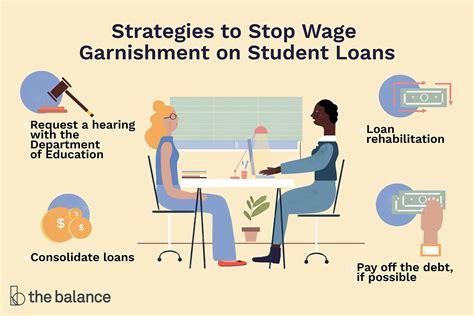

The pandemic forbearance period has provided borrowers with a temporary respite from their student loan payments. However, this relief is coming to an end, and borrowers must now prepare for the transition to a new repayment plan. It is essential to understand the implications of this change and the available options to ensure a smooth transition.

Section 2: 0% Interest Plan

The 0% interest plan is an attractive option for borrowers who want to minimize their interest payments during the transition period. Under this plan, borrowers can make interest-free payments for a specified period, usually up to 12 months. This plan is particularly beneficial for borrowers with high-interest loans, as it can save them a significant amount of money in interest charges.

Advantages of the 0% Interest Plan:

– Interest-free payments for a specified period

– Potential savings on interest charges

– No impact on credit score

Disadvantages of the 0% Interest Plan:

– May not be available for all borrowers

– Limited duration of the plan

– May require a lump-sum payment at the end of the interest-free period

Section 3: IDR Plan

The IDR plan is a more flexible option for borrowers who want to align their monthly payments with their income. This plan allows borrowers to make payments based on their income and family size, making it easier to manage their student loan debt.

Advantages of the IDR Plan:

– Payments based on income and family size

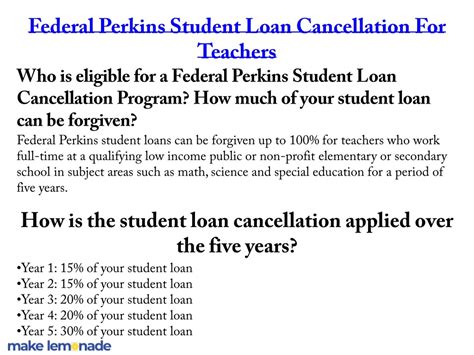

– Potential for loan forgiveness after 20 or 25 years

– No impact on credit score

Disadvantages of the IDR Plan:

– Payments may be lower, but interest will continue to accrue

– Loan forgiveness may not be ideal for all borrowers

Section 4: Transitioning from Pandemic Forbearance to a Repayment Plan

As pandemic forbearance ends, borrowers must decide which repayment plan is best suited for their financial situation. Here are some steps to help guide this decision:

1. Assess your financial situation: Determine your current income, expenses, and other debts to determine which plan is more suitable for you.

2. Research available plans: Compare the 0% interest and IDR plans to understand the benefits and drawbacks of each.

3. Consider long-term goals: Think about your career plans and financial goals to determine which plan aligns best with your future needs.

4. Contact your loan servicer: Reach out to your loan servicer to discuss your options and obtain the necessary paperwork for the chosen plan.

5. Stay informed: Keep track of your loan balance and payment schedule to ensure a smooth transition.

Conclusion:

As pandemic forbearance comes to an end, borrowers must make an informed decision on which repayment plan best suits their financial situation. By understanding the differences between the 0% interest and IDR plans, borrowers can choose the most suitable option and navigate the transition from pandemic forbearance to a new repayment plan successfully.