Title: IDR Plan Traps: Navigating the 20-Year vs 25-Year Forgiveness Tax Bomb Calculations

Introduction:

The Income-Driven Repayment (IDR) plan has been a beacon of hope for many student loan borrowers struggling to manage their debt. However, as with any financial decision, there are potential pitfalls to consider. One of the most significant concerns revolves around the tax implications of loan forgiveness after either 20 or 25 years of repayment. This article delves into the intricacies of these calculations and provides guidance on how borrowers can navigate this complex issue.

Understanding IDR Plans:

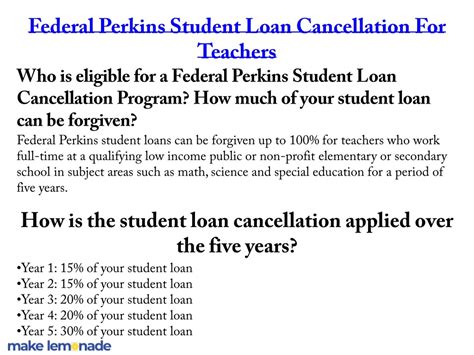

An IDR plan is a repayment plan designed to make student loan payments more manageable for borrowers with low or fluctuating income. There are four types of IDR plans: Standard, Graduated, Extended, and Income-Contingent Repayment (ICR). These plans cap monthly payments at a percentage of the borrower’s income, and any remaining balance may be forgiven after a certain period, typically 20 or 25 years.

The Tax Bomb: Understanding the Implications

When loan forgiveness occurs after 20 or 25 years, the remaining balance is considered taxable income by the IRS. This can result in a significant tax burden for borrowers, as the forgiven amount is taxed at the borrower’s marginal tax rate. This is often referred to as the “tax bomb.”

20-Year Forgiveness vs. 25-Year Forgiveness: A Comparison

The primary difference between the 20-year and 25-year forgiveness options lies in the time it takes for borrowers to become eligible for loan forgiveness. While the 20-year plan offers a faster path to forgiveness, it also comes with the potential for a larger tax bomb. Conversely, the 25-year plan provides a longer period to repay the loan, but borrowers may face a smaller tax bomb.

Calculating the Tax Bomb:

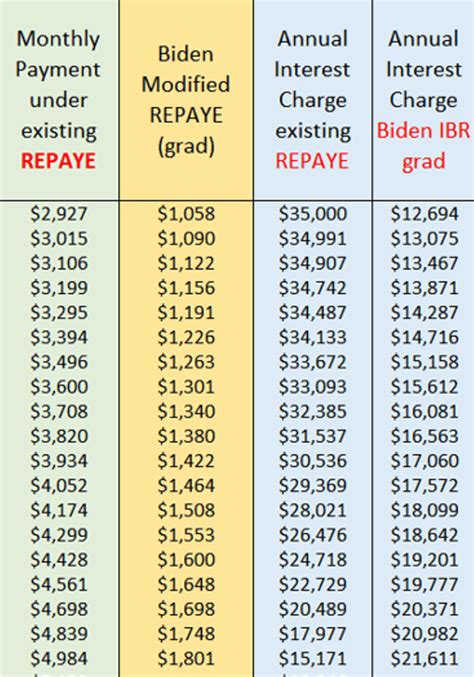

To determine the potential tax bomb, borrowers must consider the following factors:

1. Remaining loan balance: The total amount of debt still owed at the time of forgiveness.

2. Tax rate: The borrower’s marginal tax rate during the forgiveness period.

3. Forgiveness amount: The total amount of debt forgiven after 20 or 25 years of repayment.

By multiplying the forgiveness amount by the borrower’s marginal tax rate, borrowers can estimate the potential tax bomb.

Navigating the Tax Bomb:

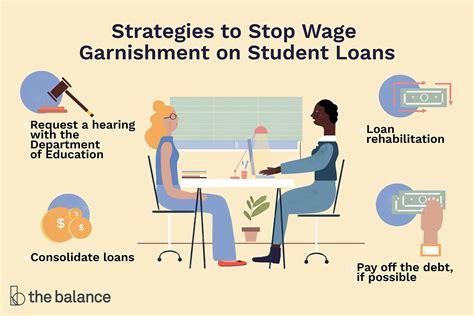

To mitigate the impact of the tax bomb, borrowers can consider the following strategies:

1. Tax Planning: Borrowers should consult with a tax professional to understand the potential tax implications of loan forgiveness and develop a tax plan to manage the resulting tax burden.

2. Paying Off Debt Early: By paying off the loan balance before forgiveness, borrowers can reduce the forgiveness amount and, consequently, the tax bomb.

3. Refinancing: Borrowers may consider refinancing their student loans to lower interest rates and potentially reduce the remaining balance, thereby decreasing the tax bomb.

Conclusion:

Navigating the 20-year vs. 25-year forgiveness tax bomb calculations can be daunting for student loan borrowers. However, by understanding the potential tax implications and implementing strategic tax planning, borrowers can make informed decisions about their repayment plans. It is crucial for borrowers to weigh the pros and cons of each option and seek professional advice to ensure they are making the best choice for their financial future.