Introduction:

Graduate school deferment can be a crucial step for many students to pursue higher education. However, it is essential to be aware of the potential dangers associated with deferring graduate school, especially concerning capitalized interest and the snowball effect. This article will delve into these risks and offer insights into how to manage them effectively.

Body:

1. Understanding Graduate School Deferment

A graduate school deferment allows students to temporarily pause their student loans to pursue further education. While this option can be beneficial for some, it is crucial to recognize the potential consequences, particularly when it comes to capitalized interest.

2. The Risk of Capitalized Interest

When you defer your student loans, interest continues to accrue on your principal balance. This means that while you are not required to make payments during the deferment period, your debt may increase over time. Capitalized interest refers to the accumulated interest that is added to your loan principal, effectively increasing the total amount you owe.

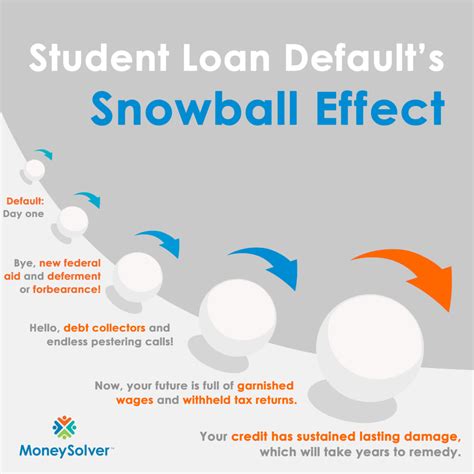

3. The Snowball Effect

The snowball effect occurs when the capitalized interest leads to an increasing debt burden, making it more challenging to repay your loans in the long run. As your principal balance grows, so does the amount of interest you accumulate during deferment, potentially leading to a larger debt load when you resume repayment.

4. Strategies to Mitigate the Dangers

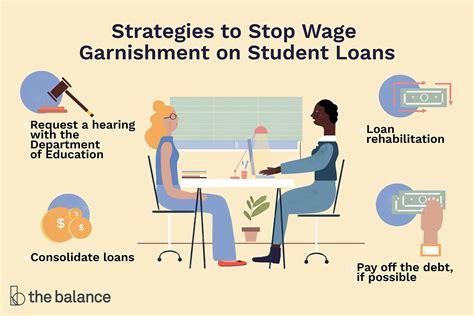

To avoid the dangers of capitalized interest and the snowball effect, consider the following strategies:

a. Understand Your Loan Terms: Familiarize yourself with the interest rates, deferment policies, and any capitalized interest rules associated with your loans.

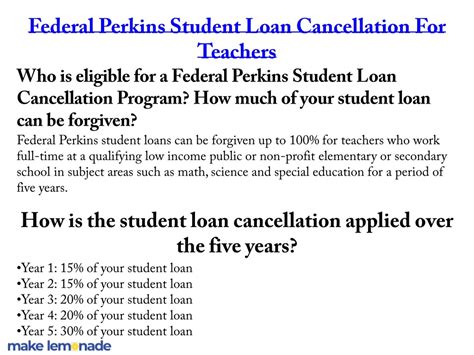

b. Consider a Repayment Plan: Explore different repayment plans offered by your lender to determine the most suitable option for your situation. Some plans, like income-driven repayment, can help minimize the impact of capitalized interest.

c. Make Interest-Only Payments: While deferring your loans, consider making interest-only payments to prevent the interest from capitalizing. This can help reduce the overall debt and make repayment more manageable.

d. Seek Financial Counseling: Consult with a financial counselor or advisor to help you navigate the complexities of your student loans and develop a tailored repayment strategy.

Conclusion:

Graduate school deferment can be a valuable tool for many students, but it is crucial to be aware of the risks associated with capitalized interest and the snowball effect. By understanding your loan terms, exploring repayment plans, making interest-only payments, and seeking financial counseling, you can mitigate these dangers and ensure a smoother repayment process in the future.