Title: Debt Fund Negotiation: Strategies for Achieving a 12% Preferred Return Hurdle Rate

Introduction:

In the world of debt funds, achieving a preferred return hurdle rate is a crucial objective for investors. A 12% preferred return hurdle rate is often seen as a benchmark for success, given the current market conditions. This article delves into the strategies that can be employed during debt fund negotiations to secure this desired return.

1. Thorough Due Diligence:

Before engaging in negotiations, it is essential to conduct thorough due diligence on the debt fund. This involves analyzing the fund’s historical performance, risk profile, and investment strategy. By understanding the fund’s track record, investors can better assess its potential to deliver a 12% preferred return.

2. Diversification:

Diversification is a key strategy to mitigate risk and enhance the likelihood of achieving the preferred return. Investors should seek to invest in a diverse portfolio of debt instruments, including corporate bonds, government securities, and mortgage-backed securities. This approach helps to spread risk and capitalize on different market opportunities.

3. Negotiating Terms:

During negotiations, investors should focus on securing favorable terms that align with their desired 12% preferred return. This may include:

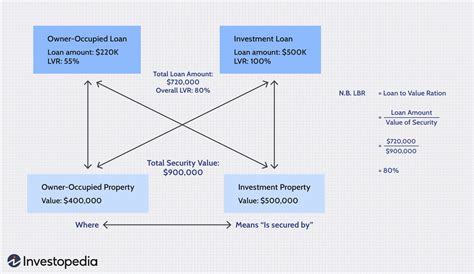

a. Interest Rate Structure: Negotiate for a fixed or floating interest rate structure that offers the potential for higher returns. Floating rates can adjust with market conditions, potentially leading to increased returns.

b. Maturity Dates: Opt for a diversified portfolio with varying maturity dates to manage interest rate risk and ensure liquidity.

c. Covenants: Include covenants that protect the investor’s interests, such as the right to information, voting rights, and the ability to appoint a representative on the issuer’s board.

4. Credit Risk Assessment:

Credit risk is a significant concern in debt funds. To achieve a 12% preferred return, it is crucial to assess the creditworthiness of the issuers. Employ a robust credit risk assessment framework to evaluate the credit ratings, financial health, and business prospects of potential investments.

5. Leveraging Market Conditions:

Monitor market conditions and leverage opportunities that arise. For instance, during periods of low interest rates, investors can negotiate more favorable terms with issuers. Additionally, staying informed about regulatory changes and market trends can help identify potential opportunities for higher returns.

6. Active Management:

Engage in active management of the debt fund by regularly reviewing and rebalancing the portfolio. This ensures that the fund remains aligned with the investor’s objectives and adjusts to changing market conditions.

Conclusion:

Achieving a 12% preferred return hurdle rate in debt fund negotiations requires a combination of thorough due diligence, diversification, favorable terms, credit risk assessment, and active management. By employing these strategies, investors can enhance their chances of securing the desired return and navigating the complexities of the debt fund market.