Title: Public Service Job Purgatory: The 7-Year PSLF Verification Paperwork Conundrum

Introduction:

In the United States, public service jobs are often seen as a noble calling, offering individuals the opportunity to contribute to the betterment of society. However, for many, the pursuit of public service comes with a steep price, particularly when it comes to student loan debt. The Public Service Loan Forgiveness (PSLF) program is designed to alleviate some of the financial burden faced by those working in public service, but the 7-year PSLF verification paperwork process has turned into a source of frustration and confusion.

The Promise of PSLF:

PSLF is a government program that promises to forgive the remaining balance on federal student loans after a borrower has made 120 qualifying payments while working in public service. The program aims to attract and retain qualified individuals in vital public sector positions, such as teaching, nursing, social work, and law enforcement.

The Verification Process:

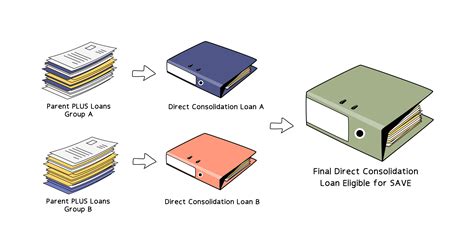

While the promise of loan forgiveness may seem straightforward, the reality is that navigating the PSLF process can be an arduous journey. One of the most challenging aspects is the 7-year verification paperwork required by the program.

The paperwork involves documenting every single payment made on the borrower’s student loans, including any payments made on behalf of the borrower. This can be particularly difficult for individuals who have worked multiple jobs or have had their loans in deferment or forbearance.

Challenges Faced by Borrowers:

1. Time-consuming: Gathering the necessary documentation for the verification process can be a massive undertaking. Borrowers must compile pay stubs, proof of employment, and other relevant information for each payment they’ve made.

2. Limited Assistance: Borrowers often find that their loan servicers and employers are ill-equipped to assist them in the verification process. This can leave them feeling stranded and unsupported in their quest for loan forgiveness.

3. Mistakes and Delays: Even with meticulous attention to detail, borrowers may still encounter errors or omissions in their paperwork. These mistakes can lead to delays or even denial of the PSLF application.

4. Lack of Communication: The PSLF program lacks a clear and concise communication strategy. Borrowers are left to navigate the process on their own, often with limited guidance or resources.

A Call for Reform:

The 7-year PSLF verification paperwork conundrum highlights the need for reform within the program. To make the process more accessible and user-friendly, the following recommendations should be considered:

1. Simplify the Documentation Process: Create a streamlined system for borrowers to submit their payment information, reducing the need for extensive paperwork.

2. Improve Communication: Develop a comprehensive communication strategy that provides borrowers with clear, concise information about the PSLF program and its requirements.

3. Enhance Support Services: Invest in training for loan servicers and employers to ensure they can provide adequate support to borrowers navigating the PSLF process.

4. Increase Transparency: Provide borrowers with regular updates on their PSLF application status, helping them stay informed about any potential issues or delays.

Conclusion:

The PSLF program is a crucial tool for supporting individuals who choose to work in public service. However, the current 7-year verification paperwork process is a source of frustration and confusion. By addressing these challenges, we can make the program more effective and ensure that public servants are able to achieve the financial stability they deserve.