Introduction:

When it comes to securing a mortgage for a high-value property, borrowers often find themselves in a unique position. Jumbo loans, which exceed the conforming loan limits set by Fannie Mae and Freddie Mac, are a popular choice for financing properties worth over $1.5 million. This article delves into the strategies for securing jumbo loans in areas with $1.5 million limit and compares them to the options offered by portfolio lenders.

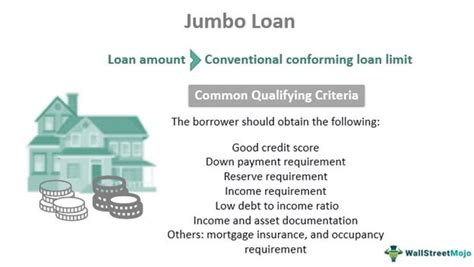

1. Understanding Jumbo Loan Limits:

In the United States, conforming loan limits vary by county and are subject to change annually. For areas with a $1.5 million limit, borrowers must navigate the intricacies of jumbo loans to finance their properties. These loans typically require a higher credit score, a larger down payment, and a more stringent debt-to-income ratio.

2. Strategies for Securing Jumbo Loans in $1.5M Limit Areas:

a. Strong Credit Score: Lenders often require a credit score of at least 700 to qualify for a jumbo loan. Maintaining a healthy credit score is crucial for borrowers in $1.5 million limit areas.

b. Larger Down Payment: A higher down payment can mitigate the risk for lenders and improve the chances of loan approval. A down payment of 20% or more is typically required for jumbo loans.

c. Debt-to-Income Ratio: Lenders may limit the debt-to-income ratio to 45% or lower for jumbo loans. Borrowers should aim to reduce their debt load to meet this requirement.

d. Loan-to-Value Ratio: A lower loan-to-value ratio can make the loan more attractive to lenders. Borrowers can achieve this by increasing their down payment or refinancing existing loans.

3. Portfolio Lender Options:

Portfolio lenders are financial institutions that retain the loans they originate on their own balance sheets, rather than selling them to investors. This allows them to offer more flexible loan terms and potentially better interest rates compared to traditional lenders.

a. Customized Loan Terms: Portfolio lenders may provide more lenient underwriting guidelines, allowing borrowers with unique situations to secure a jumbo loan.

b. Flexible Interest Rates: Portfolio lenders can offer variable or fixed interest rates, and they may be more willing to negotiate terms based on the borrower’s financial situation.

c. Longer Repayment Terms: Some portfolio lenders may offer longer repayment terms, which can reduce monthly mortgage payments for borrowers.

Conclusion:

Securing a jumbo loan in $1.5 million limit areas requires careful planning and consideration of various strategies. Borrowers should focus on maintaining a strong credit score, making a larger down payment, and reducing their debt-to-income ratio. Additionally, exploring portfolio lender options can provide more flexibility and potentially better terms. By understanding the available strategies and options, borrowers can make informed decisions when financing their high-value properties.