Introduction:

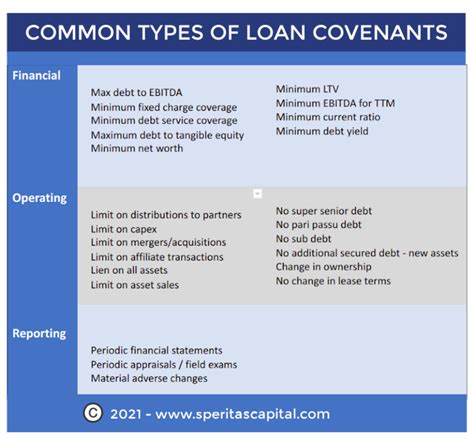

In the world of finance, loan covenants play a crucial role in ensuring that borrowers adhere to certain conditions set by lenders. These conditions are designed to mitigate risks and protect the interests of both parties. Two commonly encountered types of loan covenants are the springing and maintenance clauses. This article aims to shed light on the differences between these two clauses and their implications for borrowers and lenders.

Springing Clauses:

A springing covenant is a type of loan covenant that becomes effective only when certain triggering events occur. These events are usually related to the borrower’s financial performance or specific circumstances. Once the triggering event takes place, the covenant springs into action, imposing additional obligations on the borrower.

Key characteristics of springing clauses:

1. Conditions-based: Springing covenants are contingent upon specific events or conditions. These could include changes in the borrower’s financial ratios, such as debt-to-income ratio, or the occurrence of certain events, such as a merger or acquisition.

2. Temporary: Once the triggering event occurs, the springing covenant remains in effect until the condition is resolved or the covenant expires.

3. Less restrictive: Since springing covenants are only triggered under specific circumstances, they are generally less restrictive compared to other types of loan covenants.

Maintenance Clauses:

On the other hand, a maintenance covenant is a type of loan covenant that remains in effect throughout the life of the loan. It requires the borrower to maintain certain financial ratios or adhere to specific conditions consistently, regardless of any triggering events.

Key characteristics of maintenance clauses:

1. Ongoing: Maintenance covenants are continuously in effect, ensuring that the borrower adheres to the conditions set by the lender throughout the loan term.

2. Stringent: Maintenance covenants are often more stringent than springing covenants, as they require the borrower to maintain certain financial ratios or conditions consistently.

3. Regular reporting: Borrowers are typically required to provide regular financial reports to the lender to demonstrate compliance with maintenance covenants.

Differences between Springing and Maintenance Clauses:

1. Triggering events: Springing covenants are activated by specific events or conditions, while maintenance covenants are continuously in effect.

2. Restrictiveness: Springing covenants are generally less restrictive compared to maintenance covenants, as they only apply under certain circumstances.

3. Reporting requirements: Borrowers may be required to provide regular financial reports to demonstrate compliance with maintenance covenants, whereas springing covenants may not necessitate such frequent reporting.

Conclusion:

Understanding the differences between springing and maintenance clauses is crucial for borrowers and lenders alike. By knowing the implications of each type of covenant, borrowers can better manage their loan obligations and lenders can effectively mitigate risks. It is essential to carefully review and negotiate loan agreements to ensure that the appropriate covenants are in place for both parties’ benefit.