Title: Loan Acceleration Tactics: How Biweekly Payments and an Interest Savings Calculator Can Save You Money

Introduction:

Are you tired of paying off loans that seem to never end? Loan acceleration is a strategy that can help you pay off your debt faster and save money on interest. One effective approach is to switch to biweekly payments. In this article, we’ll discuss the benefits of biweekly payments and how an interest savings calculator can help you track your progress.

I. Understanding Biweekly Payments:

Biweekly payments involve making payments every two weeks instead of the traditional monthly schedule. This strategy helps accelerate the repayment process, as there are more payments in a year (26) than in 12 months. The result is that you pay off your loan faster, which in turn saves you money on interest.

II. Benefits of Biweekly Payments:

1. Faster loan repayment: By making half-payments every two weeks, you effectively pay an extra payment per year, which can significantly reduce the length of your loan.

2. Lower interest expenses: The earlier you pay off your loan, the less interest you’ll end up paying. This means you’ll save money over the life of the loan.

3. Improved financial stability: Paying off your loan faster can free up funds for other financial goals, such as saving for retirement or buying a home.

III. How an Interest Savings Calculator Helps:

An interest savings calculator is a powerful tool that allows you to track the benefits of switching to biweekly payments. By inputting the loan details, you can see how much interest you’ll save and how much sooner you’ll be debt-free.

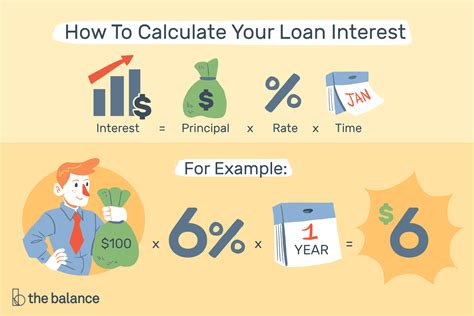

1. Loan details: Input your loan amount, interest rate, and loan term to calculate your monthly payments.

2. Biweekly payment calculation: The calculator will determine the amount of each biweekly payment, showing how much more you’ll be paying compared to monthly payments.

3. Interest savings: The calculator will show you how much interest you’ll save over the life of the loan by switching to biweekly payments.

4. Loan amortization schedule: You can view a detailed breakdown of each payment, showing how your payment is allocated towards principal and interest.

IV. Implementing the Loan Acceleration Tactics:

1. Choose the right loan: Opt for a fixed-rate loan to avoid unexpected fluctuations in interest rates.

2. Contact your lender: Ask your lender if they offer biweekly payment options and discuss any fees or adjustments involved.

3. Use an automatic payment system: Set up automatic biweekly payments to ensure you never miss a payment.

4. Track your progress: Use the interest savings calculator to stay motivated and monitor your savings over time.

Conclusion:

Loan acceleration is a smart strategy that can help you save money on interest and pay off your loans faster. By switching to biweekly payments and using an interest savings calculator, you can take control of your finances and work towards becoming debt-free. Don’t let debt weigh you down—take advantage of these loan acceleration tactics to secure a brighter financial future.