Title: Debt-to-Income Ratio Hacks: Navigating the 43% vs 36% Mortgage Approval Thresholds

Introduction:

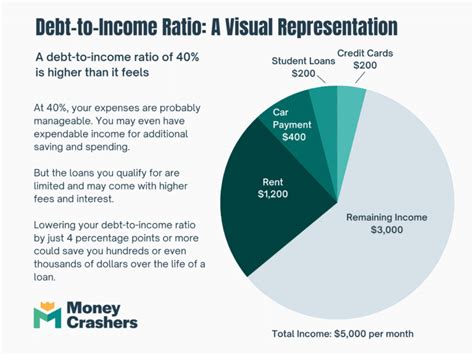

When it comes to securing a mortgage, one of the most crucial factors lenders consider is the debt-to-income (DTI) ratio. This ratio compares your monthly debt payments to your gross monthly income. While the ideal DTI ratio for mortgage approval is generally around 36%, some lenders may accept a higher ratio of 43%. In this article, we will explore various hacks to help you navigate these thresholds and increase your chances of mortgage approval.

1. Understanding the DTI Ratio:

Before diving into the hacks, it’s essential to understand how the DTI ratio works. Lenders typically use two DTI ratios: the front-end ratio and the back-end ratio. The front-end ratio considers your housing expenses (mortgage payment, property taxes, and insurance) as a percentage of your gross monthly income. The back-end ratio includes all monthly debt payments, such as credit card bills, student loans, and car payments.

2. Paying Down Existing Debt:

One of the most effective ways to improve your DTI ratio is by paying down existing debt. Focus on paying off high-interest debts first, such as credit card balances, to reduce the overall amount of debt you owe. This will lower your monthly debt payments and improve your DTI ratio.

3. Increase Your Income:

If possible, look for ways to increase your income. This could involve taking on a part-time job, freelancing, or seeking a higher-paying position. By increasing your gross monthly income, you can potentially qualify for a higher mortgage amount, even if your DTI ratio is slightly over the 43% threshold.

4. Refinance High-Interest Loans:

Refinancing high-interest loans, such as student loans or car loans, can help lower your monthly debt payments. By securing a lower interest rate, you can reduce the overall amount of debt you owe and improve your DTI ratio.

5. Consolidate Debt:

If you have multiple loans with different interest rates, consider consolidating them into a single loan with a lower interest rate. This will simplify your debt payments and potentially lower your DTI ratio.

6. Increase Your Credit Score:

A higher credit score can make a significant difference in your mortgage approval chances. Pay your bills on time, keep your credit card balances low, and avoid opening new credit lines to improve your credit score.

7. Use a Larger Down Payment:

A larger down payment can reduce the amount of mortgage insurance required and potentially lower your DTI ratio. By contributing a larger portion of the home’s purchase price upfront, you can reduce the overall debt-to-income ratio and improve your chances of mortgage approval.

8. Consider a Non-QM Loan:

If you find it challenging to meet the 43% DTI ratio threshold, you may want to explore non-qualified mortgage (Non-QM) loans. These loans have more flexible DTI requirements and may be suitable for borrowers with unique financial situations.

Conclusion:

Navigating the 43% vs 36% mortgage approval thresholds can be challenging, but with these debt-to-income ratio hacks, you can improve your chances of securing a mortgage. By paying down existing debt, increasing your income, refinancing high-interest loans, and improving your credit score, you can achieve a favorable DTI ratio and make your dream of homeownership a reality.