Introduction:

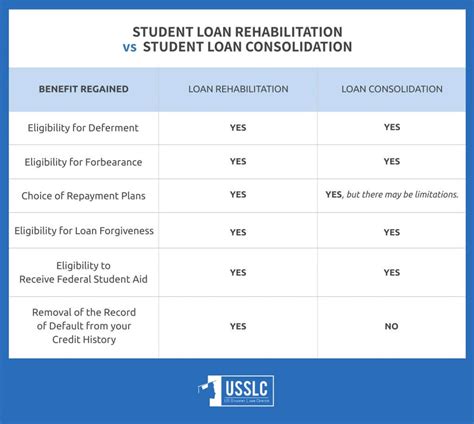

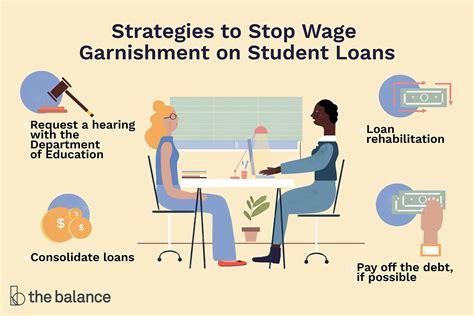

When dealing with financial difficulties, it’s crucial to understand the options available to you. Two popular solutions are loan rehabilitation and consolidation. While both aim to improve your credit report, they operate differently and have varying timelines. In this article, we will explore the differences between loan rehabilitation and consolidation and the timelines associated with repairing your credit report.

Loan Rehabilitation:

Loan rehabilitation is a process designed to help borrowers who have fallen behind on their student loans. It involves working with your loan servicer to bring your account current and establish a new repayment plan. Here’s a breakdown of the process and timeline:

1. Initial Contact: The first step is to reach out to your loan servicer to discuss your situation. This can be done through phone, email, or online communication.

2. Rehabilitation Agreement: Once you and your servicer agree on a repayment plan, you’ll enter into a rehabilitation agreement. This plan will outline the monthly payment amount, the duration of the repayment period, and any additional terms.

3. Repayment: You’ll start making monthly payments according to the rehabilitation agreement. It’s essential to make these payments on time to avoid falling behind again.

4. Credit Report Update: After making nine consecutive monthly payments, your loan servicer will report the account as “current” to the credit bureaus. This can significantly improve your credit score.

5. Full Repayment: Once you’ve completed the rehabilitation agreement, your loan will be considered in good standing. The credit bureaus will continue to report the account as “paid in full” for up to seven years.

Consolidation:

Loan consolidation combines multiple loans into a single loan, often with a lower interest rate and more manageable monthly payment. Here’s a breakdown of the process and timeline:

1. Eligibility: To consolidate your loans, you must have federal student loans. Private loans cannot be consolidated through the federal government.

2. Application: You’ll need to fill out a loan consolidation application, which can be done online or through your loan servicer.

3. Approval: Once your application is approved, you’ll receive a consolidation loan with a new interest rate and repayment terms.

4. Credit Report Update: After the consolidation loan is disbursed, your credit report will reflect the new loan. The credit bureaus will update your report to show the combined loan amount and the new repayment terms.

5. Repayment: You’ll start making monthly payments on the consolidated loan. Timely payments will help improve your credit score.

6. Credit Report Timeline: The credit bureaus will continue to report the consolidated loan as “paid in full” for up to seven years after the loan is paid off.

Conclusion:

Both loan rehabilitation and consolidation can help improve your credit report. The timeline for repairing your credit report depends on the specific situation and the terms of the agreement. While loan rehabilitation focuses on bringing your student loans current, consolidation combines multiple loans into one. It’s essential to understand the differences and timelines associated with each option to make an informed decision that suits your financial needs.