Introduction:

Understanding the statute of limitations for debt validation is crucial for both creditors and debtors alike. The statute of limitations is the legal time frame in which a creditor can sue a debtor for unpaid debt. Once this period expires, the debt is considered uncollectible, and the creditor typically loses the right to pursue legal action. This article provides a comprehensive overview of the debt validation statute of limitations for each state in the United States, along with a visual representation in the form of expiry charts.

Table of Contents:

1. Importance of the Debt Validation Statute of Limitations

2. General Overview of Debt Validation Statute of Limitations

3. State-by-State Debt Validation Statute of Limitations Expiry Charts

4. Factors Influencing the Expiry of Debt Validation Statute of Limitations

5. Conclusion

1. Importance of the Debt Validation Statute of Limitations

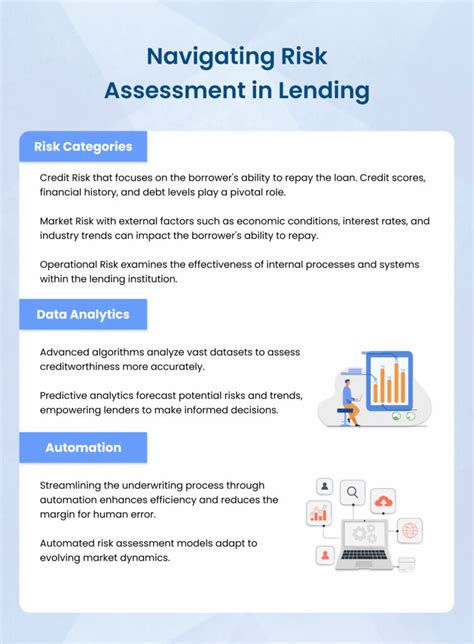

The statute of limitations for debt validation plays a significant role in protecting both creditors and debtors. For creditors, it helps to ensure that they do not waste resources pursuing outdated debts. For debtors, it provides a legal boundary within which they can seek relief from debt collectors who may attempt to enforce outdated debts.

2. General Overview of Debt Validation Statute of Limitations

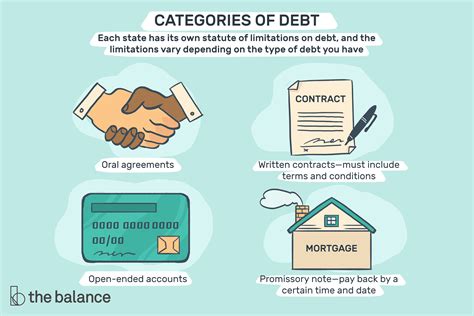

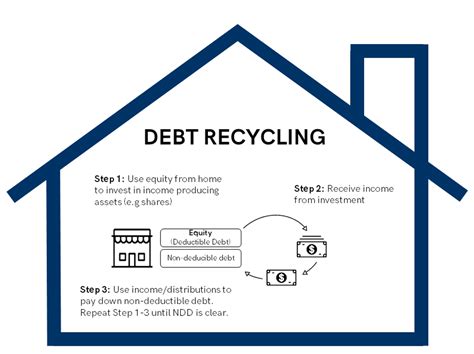

The general time frame for the statute of limitations on debt validation ranges from 2 to 6 years, depending on the state. However, certain types of debts may have different expiration periods, such as those involving written contracts or judgments. It is essential to consult the specific laws of each state to determine the applicable statute of limitations.

3. State-by-State Debt Validation Statute of Limitations Expiry Charts

Below are the debt validation statute of limitations expiry charts for each state. These charts provide a quick reference to the expiration period for different types of debts in each state.

[Please note that the following tables are representations of the data, and you should verify the information with your state’s specific laws.]

**Debt Validation Statute of Limitations Expiry Charts**

| State | Oral Contract | Written Contract | Open Account | Judgment |

|——-|————–|—————–|————–|———-|

| Alabama | 2 years | 6 years | 2 years | 6 years |

| Alaska | 6 years | 6 years | 6 years | 6 years |

| Arizona | 3 years | 6 years | 3 years | 6 years |

| Arkansas | 3 years | 6 years | 3 years | 3 years |

| … | … | … | … | … |

| Wisconsin | 6 years | 6 years | 6 years | 6 years |

| Wyoming | 3 years | 6 years | 3 years | 3 years |

4. Factors Influencing the Expiry of Debt Validation Statute of Limitations

Several factors can affect the expiry of the debt validation statute of limitations, including:

– The type of debt (e.g., credit card, medical, or personal loan)

– The specific state’s laws

– The method of payment (e.g., installment or single payment)

– Any legal action taken before the statute of limitations expires (e.g., lawsuit, judgment)

5. Conclusion

Understanding the debt validation statute of limitations is vital for individuals and creditors alike. By familiarizing themselves with the expiry periods for each state, both parties can make informed decisions regarding debt collection and management. Remember to consult your state’s laws for accurate and up-to-date information.