Introduction:

Managing credit effectively is a crucial aspect of financial health. One key metric that financial institutions and consumers alike closely monitor is the debt-to-credit ratio. This ratio is a reflection of an individual’s creditworthiness and their ability to manage debt. This article delves into the significance of the 30% utilization threshold and explores the optimization paths to fix debt-to-credit ratios.

Understanding the Debt-to-Credit Ratio:

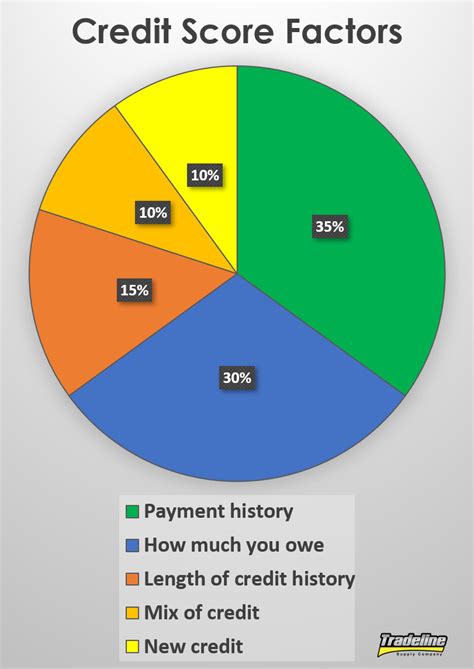

The debt-to-credit ratio, also known as the credit utilization ratio, measures the percentage of a consumer’s available credit that is being used. It is calculated by dividing the total credit card balances by the total credit limits. A lower debt-to-credit ratio is generally considered healthier for a person’s credit score.

The 30% Utilization Threshold:

The 30% utilization threshold is often cited as a benchmark for maintaining a good debt-to-credit ratio. According to financial experts, keeping credit card balances below 30% of the credit limit can help improve a person’s credit score and financial standing.

Optimization Paths to Fix Debt-to-Credit Ratios:

1. Assess Your Current Debt-to-Credit Ratio:

The first step in fixing your debt-to-credit ratio is to assess your current situation. Review your credit card statements and calculate your debt-to-credit ratio. If you find that your ratio is above 30%, it’s time to take action.

2. Pay Down High-Interest Debt:

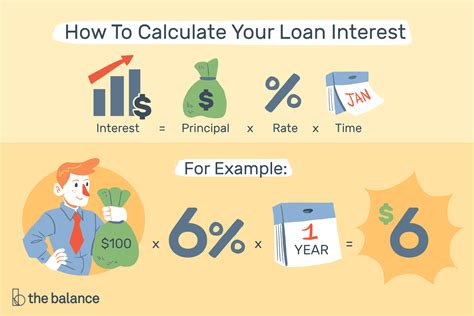

Prioritize paying down high-interest debt to reduce your overall balance. High-interest debt can be a significant burden and can hinder your efforts to lower your debt-to-credit ratio. Consider consolidating your high-interest debts into a single loan with a lower interest rate to streamline the repayment process.

3. Increase Your Credit Limits:

Requesting credit limit increases can help lower your debt-to-credit ratio. By increasing your credit limits, you can reduce the percentage of your credit that is being used. However, be cautious and avoid requesting too many credit limit increases in a short period, as this can negatively impact your credit score.

4. Pay Your Credit Card Bills on Time:

Paying your credit card bills on time is crucial for maintaining a good debt-to-credit ratio. Late payments can significantly damage your credit score and increase your debt-to-credit ratio. Set reminders or automate your payments to ensure timely payments.

5. Monitor Your Credit Score:

Regularly monitoring your credit score can help you track your progress in fixing your debt-to-credit ratio. Use free credit score monitoring services to stay informed about any changes in your creditworthiness.

6. Avoid Opening New Credit Accounts:

Opening new credit accounts can temporarily lower your credit score and increase your debt-to-credit ratio. If you’re working to improve your ratio, it’s best to avoid applying for new credit accounts unless absolutely necessary.

Conclusion:

Fixing your debt-to-credit ratio and maintaining a 30% utilization threshold is essential for financial stability and a healthy credit score. By following the optimization paths outlined in this article, you can take control of your finances and work towards a better debt-to-credit ratio. Remember, it’s a gradual process, and patience is key to achieving long-term success.