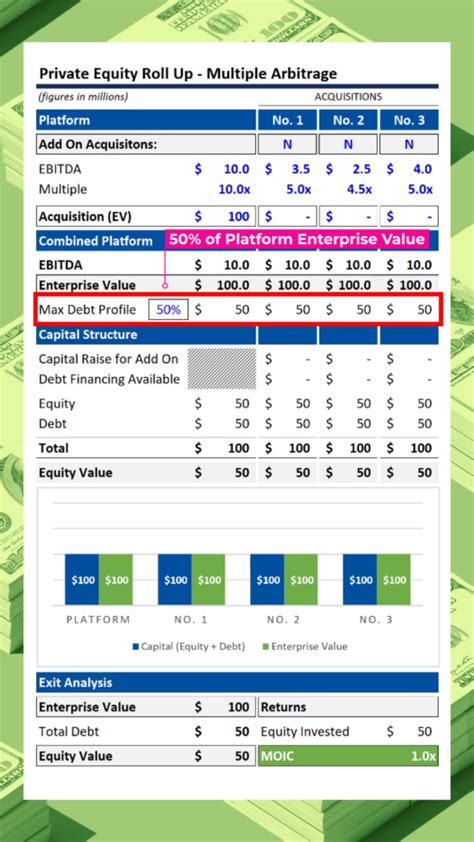

In the world of mergers and acquisitions, roll-up financing is a popular strategy used by private equity firms to rapidly grow their portfolios by acquiring multiple companies. However, when the debt-to-equity ratio is as high as 80%, the risks involved can be substantial. This article will delve into the potential risks associated with roll-up financing and acquiring three businesses with an 80% debt burden.

1. High Interest Rates and Debt Service Obligations

One of the primary risks of roll-up financing with an 80% debt-to-equity ratio is the potential for high interest rates. Lenders may view the acquisition as riskier due to the high debt load, leading to higher interest rates on the borrowed funds. This can significantly increase the cost of capital for the acquiring company, making it more challenging to achieve the desired returns on investment.

Additionally, with such a high debt service obligation, the acquiring company will need to allocate a substantial portion of its cash flow to meet interest and principal payments. This can leave limited funds available for other critical business operations, such as research and development, marketing, and capital expenditures.

2. Increased Vulnerability to Economic Downturns

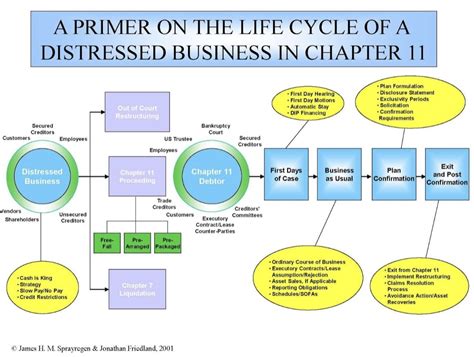

When a company has an 80% debt-to-equity ratio, it is more vulnerable to economic downturns. During a recession, revenue growth may slow, and profit margins could shrink, making it difficult for the company to meet its debt obligations. This could lead to a credit rating downgrade, increased borrowing costs, or even bankruptcy.

Moreover, a high debt load can make it challenging for the acquiring company to adapt to changing market conditions. The need to focus on meeting debt obligations may divert management’s attention away from strategic initiatives and long-term growth prospects.

3. Limited Flexibility in Business Decisions

A substantial debt burden can limit the flexibility of a company in making strategic business decisions. The acquiring company may be forced to prioritize debt repayment over investments in new projects or expansion opportunities. This can hinder the company’s ability to innovate and compete effectively in the market.

Furthermore, a high debt-to-equity ratio can make it difficult to secure additional financing for future acquisitions or capital investments. Lenders may be wary of providing additional funds to a company with an already high debt load, potentially stalling growth plans.

4. Tax Implications

Acquiring businesses with an 80% debt-to-equity ratio can have significant tax implications. Interest payments on debt are typically tax-deductible, which can provide some relief for the company’s tax burden. However, the tax benefits may be offset by the increased cost of capital due to higher interest rates.

Moreover, if the acquiring company’s earnings are not sufficient to cover the interest payments, it may experience a situation known as “financial distress.” In such cases, the company may face higher corporate tax rates, as well as potential penalties and interest charges on underpayments.

Conclusion

While roll-up financing can be an effective strategy for growing a private equity portfolio, acquiring three businesses with an 80% debt-to-equity ratio comes with significant risks. High interest rates, vulnerability to economic downturns, limited flexibility in business decisions, and tax implications are just a few of the challenges that may arise. Private equity firms must carefully evaluate these risks and develop a robust plan to mitigate them before proceeding with such an acquisition strategy.