Introduction:

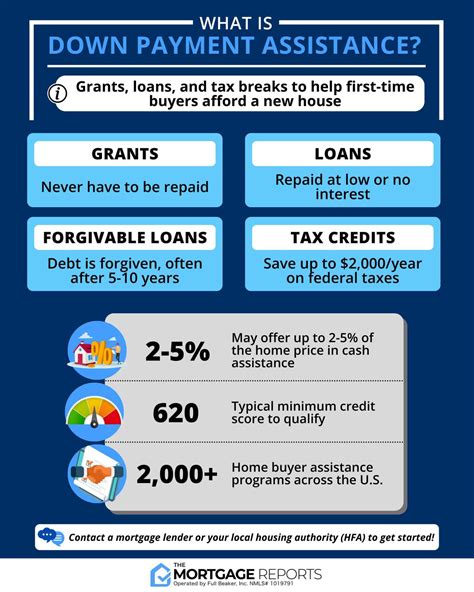

When it comes to purchasing a home, one of the most significant hurdles for many buyers is the down payment. However, down payment assistance programs can help make homeownership more accessible. In this article, we will explore two popular options: 3% grants and silent second liens, and discuss the differences between them.

3% Grants:

A 3% grant is a type of down payment assistance program where the lender provides the borrower with a grant amount equal to 3% of the home’s purchase price. This grant is meant to help eligible borrowers cover the down payment and closing costs, making it easier for them to enter the housing market.

Advantages of 3% Grants:

1. No repayment required: Unlike loans, 3% grants do not need to be repaid, which can be a significant financial relief for many buyers.

2. Lower down payment requirements: With a 3% grant, borrowers can purchase a home with a smaller down payment, reducing the amount of money they need to have upfront.

3. Eligibility requirements: Many 3% grant programs have flexible eligibility requirements, making them accessible to a wide range of buyers.

Disadvantages of 3% Grants:

1. Limited availability: Not all lenders offer 3% grant programs, and some may have strict guidelines for eligibility.

2. Potential impact on credit score: Although 3% grants do not require repayment, they may still be reported on the borrower’s credit report, which could affect their credit score.

Silent Second Liens:

A silent second lien is another form of down payment assistance that involves a second mortgage with a lower interest rate and longer repayment term. The primary mortgage is still the first lien on the property, but the silent second lien is “silent” because it does not require monthly payments or interest until the borrower sells or refinances the property.

Advantages of Silent Second Liens:

1. Lower interest rates: Silent second liens often have lower interest rates than traditional mortgages, which can save borrowers money on interest payments.

2. Longer repayment term: With a longer repayment term, borrowers may have more time to pay off the silent second lien without impacting their monthly budget.

3. Flexibility: Silent second liens can be more flexible than other forms of down payment assistance, as they can be structured to fit the borrower’s needs.

Disadvantages of Silent Second Liens:

1. Higher overall cost: While silent second liens may have lower interest rates, the extended repayment term can lead to a higher overall cost of the loan.

2. Potential default risk: If the borrower fails to pay off the silent second lien when selling or refinancing, they may face default and potential foreclosure.

3. Limited eligibility: Similar to 3% grants, silent second liens may have strict eligibility requirements and are not offered by all lenders.

Conclusion:

Both 3% grants and silent second liens offer potential benefits for homebuyers looking for down payment assistance. However, each option has its pros and cons, and borrowers should carefully consider their financial situation and long-term goals before choosing the best program for them. Consulting with a financial advisor or mortgage professional can help borrowers make an informed decision that aligns with their needs.