Introduction:

Employee Stock Ownership Plans (ESOPs) have become a popular financing option for businesses seeking to raise capital. However, the process of financing an ESOP can be complex, especially when it comes to choosing the right leverage model. This article aims to compare the complexities associated with two common financing methods: the 401(k) leverage model and the bank loan leverage model.

401(k) Leverage Model:

The 401(k) leverage model involves using the funds accumulated in an employee’s 401(k) retirement account to finance an ESOP. This method offers several advantages:

1. Tax advantages: Contributions to a 401(k) plan are tax-deductible for both the employer and the employee, reducing the overall cost of financing.

2. Accessibility: Employees who participate in a 401(k) plan can easily transfer their funds to an ESOP, making this financing option more accessible.

3. Employee engagement: By using their own retirement funds, employees have a personal stake in the company’s success, potentially increasing their engagement and loyalty.

However, the 401(k) leverage model also comes with certain complexities:

1. Employee consent: Transferring funds from a 401(k) account requires the consent of the employee, which may not always be obtained.

2. Plan design: The design of the 401(k) plan must be carefully structured to ensure that employees’ funds are available for the ESOP and that the plan remains compliant with IRS regulations.

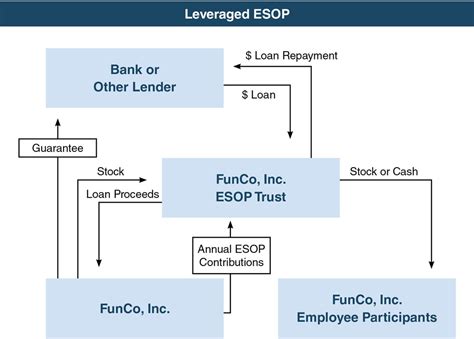

Bank Loan Leverage Model:

The bank loan leverage model involves obtaining a loan from a financial institution to finance an ESOP. This method offers the following advantages:

1. Flexibility: Bank loans can be tailored to meet the specific needs of the business, allowing for more control over the financing terms.

2. Independence: Using a bank loan keeps the ESOP separate from the company’s employee retirement plans, which can be beneficial for certain legal and regulatory purposes.

3. Interest deductions: Interest payments on bank loans can be tax-deductible, providing additional tax advantages.

Despite these benefits, the bank loan leverage model also presents some complexities:

1. Creditworthiness: The business must have a strong credit history and financial stability to secure a bank loan.

2. Debt obligations: The business will be responsible for repaying the loan, which may require significant cash flow management.

3. Interest rates: Bank loans typically come with variable interest rates, which can fluctuate over time, potentially increasing the cost of financing.

Conclusion:

Both the 401(k) leverage model and the bank loan leverage model have their own set of complexities when it comes to financing an ESOP. Businesses must carefully consider their unique circumstances, including employee participation, tax implications, and financial stability, to determine the most suitable financing option. By understanding the complexities associated with each method, businesses can make an informed decision that aligns with their long-term goals and objectives.