Introduction:

Loan participations have become a popular investment strategy for many institutional investors, offering a way to diversify their portfolios and potentially earn higher returns. However, like any investment, loan participations come with their own set of risks. This article will explore the risks associated with loan participations, particularly focusing on the 40% syndicated deal exposure limits.

1. Understanding Loan Participations:

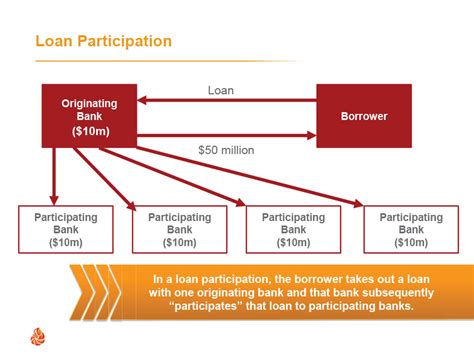

Loan participations involve investing in a portion of a loan that has been syndicated by a bank or financial institution. This allows investors to gain exposure to the credit risk of the borrower without having to take on the entire loan. The syndication process involves multiple banks and investors sharing the risk and return on the loan.

2. Risks of Loan Participations:

a. Credit Risk: The primary risk of loan participations is the credit risk associated with the borrower. If the borrower defaults on the loan, investors in the participation may lose their investment. This risk is particularly significant in high-risk industries or for borrowers with poor credit histories.

b. Market Risk: Loan participations are subject to market risk, which can impact the value of the investment. Factors such as changes in interest rates, economic conditions, and industry-specific developments can affect the borrower’s ability to repay the loan, thereby impacting the investor’s returns.

c. Liquidity Risk: Loan participations may be less liquid than other investment vehicles, as they are typically long-term investments. This can make it challenging for investors to exit their positions quickly, especially during times of market stress.

3. 40% Syndicated Deal Exposure Limits:

To mitigate the risks associated with loan participations, many institutional investors have implemented exposure limits. One common limit is the 40% syndicated deal exposure limit, which restricts an investor’s participation in a single loan to no more than 40% of the total loan amount.

a. Benefits of the 40% Limit:

– Diversification: The limit encourages investors to diversify their loan participations across multiple borrowers and industries, reducing the impact of any single default.

– Risk Management: By limiting exposure to a single loan, investors can better manage their credit risk and ensure that their overall portfolio remains balanced.

b. Drawbacks of the 40% Limit:

– Potential for Missed Opportunities: In some cases, the 40% limit may prevent investors from participating in particularly attractive loan opportunities.

– Increased Transaction Costs: Diversifying across multiple loans can lead to higher transaction costs, as investors may need to engage with multiple banks and financial institutions.

Conclusion:

Loan participations offer investors the potential for higher returns, but they also come with their own set of risks. The 40% syndicated deal exposure limit is one way to mitigate these risks, but it is essential for investors to carefully consider their risk tolerance and investment strategy. By understanding the risks and implementing appropriate limits, investors can make more informed decisions and better manage their loan participation investments.