Introduction:

In the realm of real estate transactions, buydown agreements play a significant role in facilitating home purchases. These agreements involve a buyer, a seller, and sometimes a third party, where the rate of interest on a mortgage is temporarily or permanently reduced. However, with such an intricate financial arrangement, it is crucial to understand the risks associated with temporary and permanent rate reductions. This article delves into the potential pitfalls of both approaches to help you make an informed decision.

Section 1: Temporary Rate Reductions

1.1 Definition:

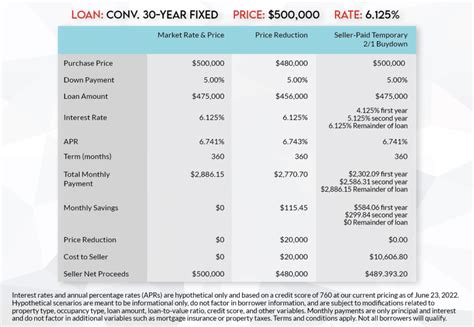

A temporary rate reduction buydown agreement is a plan where the seller, or sometimes a third party, pays additional funds to the lender to lower the initial interest rate on the mortgage for a specified period. This reduction can last for a few years, typically 1-5 years, after which the rate reverts to the market rate.

1.2 Risks:

a. Market Fluctuations: The temporary rate reduction may not protect against future rate increases. If interest rates rise after the buydown period ends, the buyer may face higher monthly payments.

b. Seller Dependency: The temporary rate reduction is contingent upon the seller’s willingness to pay the additional funds. If the seller fails to honor the agreement, the buyer may face financial strain.

c. Buydown Costs: While temporary buydowns may lower monthly payments initially, they can be expensive. Sellers may be required to pay thousands of dollars upfront to secure the reduced rate.

Section 2: Permanent Rate Reductions

2.1 Definition:

A permanent rate reduction buydown agreement involves a permanent decrease in the interest rate on the mortgage, regardless of market fluctuations. This reduction remains in effect throughout the life of the loan.

2.2 Risks:

a. Higher Upfront Costs: Permanent rate reductions typically involve higher upfront costs compared to temporary reductions. The buyer may need to pay more money to secure the lower rate, which could affect their finances.

b. Longer Repayment Period: With a lower interest rate, the repayment period may be extended. This means the buyer will pay more interest over the life of the loan, potentially increasing the total cost of the mortgage.

c. Market Changes: Although permanent rate reductions are not subject to market fluctuations, they may not provide the flexibility that buyers desire in case they decide to refinance or sell the property in the future.

Conclusion:

In conclusion, both temporary and permanent rate reductions in buydown agreements come with their respective risks. Temporary reductions can provide immediate relief but may not protect against future market fluctuations. On the other hand, permanent reductions offer long-term stability but may come with higher upfront costs and extended repayment periods. It is essential for buyers to weigh the pros and cons of each option and consult with a financial advisor to make the best decision for their specific needs.