Introduction:

Navigating the world of franchise financing can be a daunting task, especially when it comes to understanding the differences between brand-approved loans and third-party loan terms. Both options have their own set of advantages and potential pitfalls, and it’s crucial for aspiring franchise owners to be aware of these factors to make an informed decision. This article delves into the key differences and potential traps associated with brand-approved and third-party loan terms, helping you choose the best financing option for your franchise venture.

1. Brand-Approved Loan Terms:

Brand-approved loans are loans that are offered directly by the franchisor, often through their preferred financial institution. Here are some of the key aspects to consider:

a. Benefits:

– Streamlined process: Brand-approved loans typically have a simplified application process, as they are tailored specifically for the franchise system.

– Competitive rates: Franchisors often negotiate better rates with financial institutions, providing you with favorable terms.

– Enhanced credibility: Borrowing through the franchisor can enhance your credibility as a franchisee, making it easier to secure additional funding if needed.

b. Potential Traps:

– Limited options: Brand-approved loans may limit your choices in terms of financial institutions and loan products.

– Higher fees: Some franchisors may charge higher fees for their preferred financing options.

– Brand-specific requirements: The franchisor may impose specific requirements, such as using their preferred vendor for equipment or supplies.

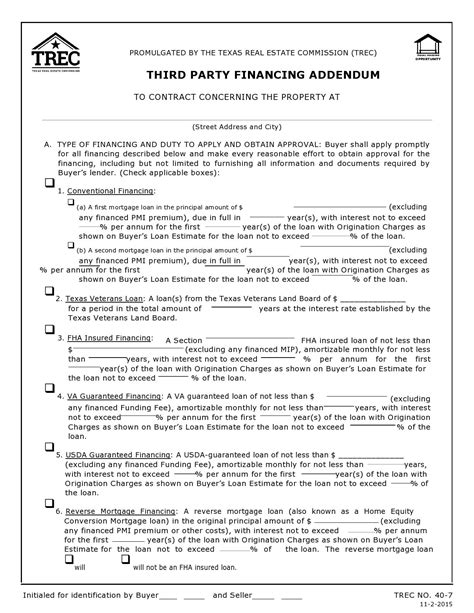

2. Third-Party Loan Terms:

Third-party loans are obtained from financial institutions that are not affiliated with the franchisor. Here’s what you should know:

a. Benefits:

– Broader options: Third-party loans offer a wider range of loan products and financial institutions, providing you with more flexibility.

– Negotiable terms: You have the freedom to negotiate the terms of the loan, including interest rates, repayment periods, and collateral requirements.

– Potential for better rates: With a competitive market, third-party loans may offer better rates and terms than brand-approved loans.

b. Potential Traps:

– More complex process: Applying for a third-party loan can be more time-consuming and complicated compared to brand-approved loans.

– Higher risk: Financial institutions may view third-party loans as riskier, leading to stricter credit requirements and potentially higher interest rates.

– Less support: Unlike brand-approved loans, third-party loans may not provide the same level of support and guidance from the franchisor.

Conclusion:

When choosing between brand-approved and third-party loan terms for your franchise financing, it’s essential to weigh the benefits and potential traps of each option. Consider your specific needs, financial situation, and long-term goals to make the best decision for your franchise venture. Whether you opt for brand-approved or third-party loans, ensure you thoroughly research and compare the terms and conditions before signing any agreements. Remember, making an informed choice can make a significant difference in the success of your franchise business.