Introduction:

Student loans have become an integral part of the higher education landscape, providing financial assistance to countless students. However, disputes over student loan charges, particularly unauthorized disbursement reversals, have become a source of concern for many borrowers. This article delves into the complexities of these disputes and explores the potential consequences for borrowers.

I. Understanding Unauthorized Disbursement Reversals

1. What is an unauthorized disbursement reversal?

An unauthorized disbursement reversal refers to the situation where a student loan lender or school reverses a disbursement that was not authorized by the borrower or the loan servicer. This reversal typically occurs when there is a discrepancy in the loan information or when the borrower fails to complete the necessary paperwork.

2. Common causes of unauthorized disbursement reversals

a. Errors in loan processing

b. Inaccurate information provided by the borrower or school

c. Changes in enrollment status

d. Borrower withdrawal or drop in course load

II. Disputing Unauthorized Disbursement Reversals

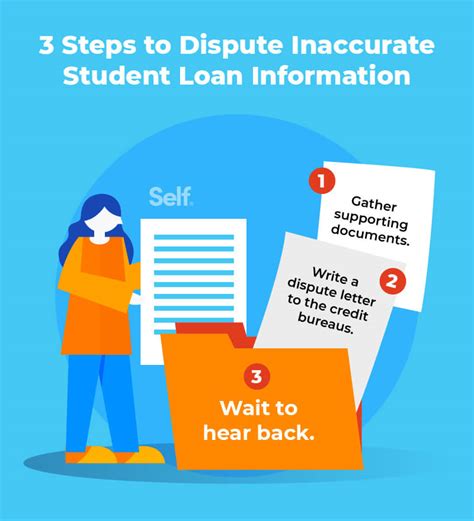

1. Steps to dispute an unauthorized disbursement reversal

a. Contact your loan servicer or school immediately to report the issue

b. Gather all relevant documentation, such as loan agreements, disbursement records, and enrollment status

c. Request a written explanation for the reversal

d. Follow up with your loan servicer or school to resolve the dispute

2. The importance of timely action

Disputing an unauthorized disbursement reversal as soon as possible is crucial to minimize the potential impact on your loan and credit score. Delaying the process may result in additional fees, penalties, or even legal action.

III. Consequences of Unauthorized Disbursement Reversals

1. Financial implications

a. Potential for late fees and increased interest rates

b. Negative impact on credit score

c. Possible legal action by the lender or school

2. Emotional and mental health impact

Dealing with unauthorized disbursement reversals can be stressful and overwhelming. Borrowers may experience anxiety, depression, and other mental health issues due to the financial and administrative burden.

IV. Protecting Yourself from Unauthorized Disbursement Reversals

1. Stay informed about your loan status

Regularly monitor your loan account to ensure accurate disbursements and identify any discrepancies promptly.

2. Keep all documentation

Maintain copies of loan agreements, disbursement records, and enrollment status to support your claims during disputes.

3. Communicate with your loan servicer or school

Establish open lines of communication with your loan servicer or school to address any concerns or questions regarding your loan.

Conclusion:

Unauthorized disbursement reversals in student loans can have significant consequences for borrowers. By understanding the causes, steps to dispute reversals, and potential consequences, students can take proactive measures to protect themselves and minimize the impact of these disputes. It is crucial to stay informed, maintain clear communication, and act promptly to resolve any issues related to unauthorized disbursement reversals.