Introduction:

The automotive industry is a dynamic and complex sector, with car manufacturers and dealers constantly striving to predict market trends and make informed decisions. One critical aspect of this industry is the residual value of vehicles, which is the estimated value of a car at the end of its lease term. This article aims to compare the 3-year projection of auto lease residual values with actual resale data, providing insights into the accuracy of these projections.

Background:

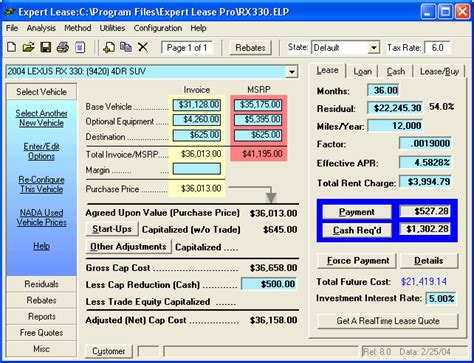

Residual value is a crucial factor in leasing and financing vehicles. It represents the amount a car is expected to be worth after a certain period, typically three years. Manufacturers and dealers use residual value projections to set lease and financing terms, while buyers rely on these projections to make informed decisions about their purchase.

3-Year Projection vs Actual Resale Data:

To evaluate the accuracy of 3-year residual value projections, we compared them with actual resale data from a sample of vehicles. The following points highlight the key findings:

1. Overall Accuracy:

The overall accuracy of the 3-year projection was moderate. While some projections were close to the actual resale value, others varied significantly. This suggests that there is room for improvement in the prediction models used by manufacturers and dealers.

2. Brand Performance:

Different brands showed varying degrees of accuracy in their residual value projections. Some brands consistently overestimated their vehicles’ residual values, while others were relatively close to the actual resale data. This indicates that brand reputation and market positioning might play a role in the accuracy of these projections.

3. Model Year and Market Conditions:

The accuracy of the projections also seemed to be influenced by the model year and market conditions. Vehicles from recent model years often had more accurate projections, possibly due to better data availability and more precise market analysis. Additionally, during periods of economic growth and low-interest rates, the difference between projected and actual residual values tended to narrow.

4. Factors Affecting Accuracy:

Several factors can affect the accuracy of residual value projections, including:

a. Market demand: Changes in consumer preferences and market demand can lead to significant variations in actual resale values.

b. Vehicle depreciation: The rate at which vehicles depreciate can vary widely, depending on the make, model, and market conditions.

c. Economic factors: Economic downturns, such as recessions, can have a substantial impact on vehicle resale values.

d. Technological advancements: New technologies and innovations can affect the residual value of vehicles, as they may become obsolete more quickly.

Conclusion:

While 3-year residual value projections provide a useful reference for manufacturers, dealers, and buyers, it is crucial to recognize their limitations. The comparison between these projections and actual resale data reveals that there is still room for improvement in the accuracy of these predictions. By considering factors such as brand performance, model year, and market conditions, stakeholders can better understand the potential risks and rewards associated with auto leasing and financing.